With a weaker China in demand for meat and prices that it proposes, and a meatpacking industry that is better positioned for the slaughter of farmyard animals, fat cattle market stabilizes in values.

The differential in prices and inputs persists between those plants that begin to focus on the slaughter of penned cattle destined for quota 481 and also non-quota, and the others.

Those that do not make a quota and do not have pens are the most avid and with shorter entries, around a week, while those that start with the pens go to 10-15 days.

The best special and heavy steers are quoted at US$ 4.30 per kilo in the fourth scale. Most businesses are at $4.25. The heavy fat cow is marketed at US$3.90 and the heifer at US$4. Prepared cattle still do not appear.

“I think that stability is going to be maintained (…), I don’t think they can lower it,” said Alejandro Arralde, from the Alejandro Arralde Rural Business desk.

The greens have slowed down, the water has been cut off, a stoppage that further delays the departure of the special fat cattle, the operator remarked.

Weekly closing of markets.

The external signs are of a more blocked Chinese demand, with a drop in values. “The market is heavier, more difficult to move,” said an operator, among other things, speculating about the possible authorization of more Brazilian refrigeration plants to export to that destination.

“There is also talk that there is a lot of stock, that consumption has dropped and they are putting pressure on prices,” he said, pointing out that there are few businesses from Uruguay and it is difficult to close new ones.

There is expectation for the signs that can be given at the next SIAL fair, in China, between May 18 and 20, in which government authorities and representatives of the Uruguayan private sector will say present.

In this stage, the cattle slaughter had its fourth consecutive week below 40,000 heads and achieved an average of 35,493 animals per week in the last 30 mobile days. The last week was 37,324 bovines.

The stability of livestock prices is also seen in the value of the exported beef ton, last week it averaged US$ 4,526according to provisional data from the National Meat Institute (INAC) and in the last 30 moving days the average was US$ 4,448, unchanged from the previous data.

The lack of rain and the forage brake put a cold cloth on the increases that the replacement market brought. “Short deals, which are the wintering cow and the trained steer, are going to get a little more complicated,” Arralde pointed out, but those of calves, and those of whole calves for export, are in high demand, he said.

“Exports are moving a lot, which is what sustains the market and puts a floor on it, that speaks clearly that the replacement does not seem to suffer,” he said.

In the virtual auctions this week, both in Plaza Rural on Tuesday and in Uruguay Screen this Wednesday, similar values were observed or with slight adjustments compared to previous auctions. Marketed calves averaged US$2.57 per kilo. Some caution is noted.

firmness in the wool

In sheep, firmness predominates, with values around US$ 3.42 for heavy lambUS$3.44 for sheep, US$3.15 for capons and US$3.08 for sheep. The volume of slaughter is worrying, which last week rose 30% compared to the previous week, with 38,538 sheep, almost triple that of the same week in 2022, when 13,168 animals were counted.

The return of the drought

In western Uruguay Concern continues over the lack of rain that prevents the sowing of winter cropsthe same situation that occurs in Argentina and that can last at least until mid-May.

While the very meager harvest of a summer crop that will not reach a million tons of soybeans is being harvested, the delay in the rains that allow wheat, barley and rapeseed to sow is worrying as the days go by.

In the case of the oilseed, it is already given as a fact that the area will have a significant decrease.

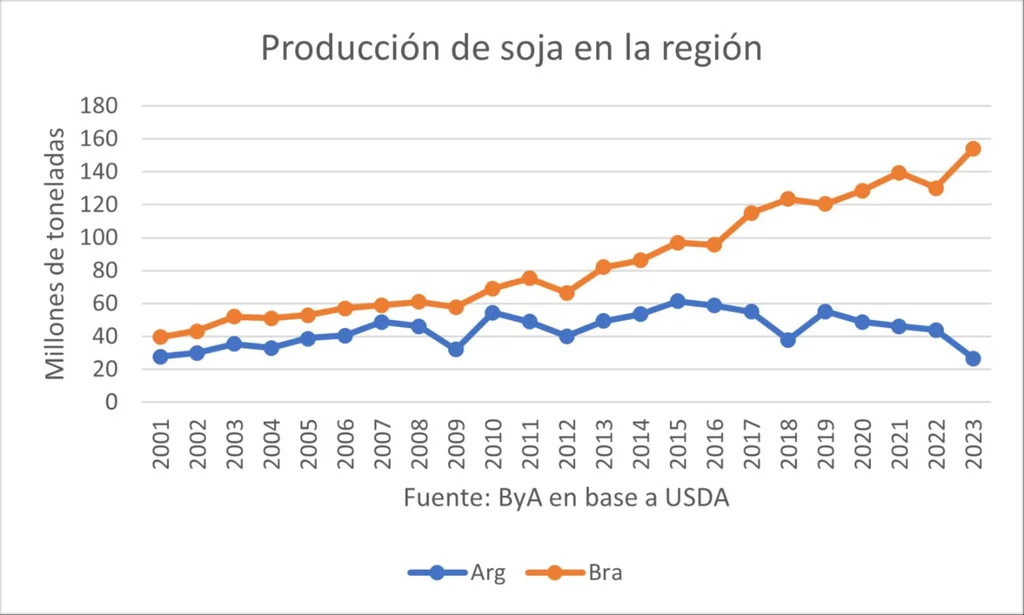

Because on the other hand, although this Friday there was a small rebound in prices, what ended was the second consecutive week of strong falls in the international prices of wheat, corn and soybeans, as a consequence of the strong export of Brazilian soybeans, and the advance of the sowings of the United States that has calmed the perspectives of the future offer of American grains.

In the case of wheat, it is the large exports from Russia that maintain the downward pressure.

So this week soybeans lost the reference of US$500 per ton to close at US$493.

The price of rapeseed also fell, going to US$405, while wheat, which had remained stable at US$285, corrected to US$270.

Finally, barley is under pressure both from the drop in wheat in Chicago and from Australia’s increased export of feed barley to China.

In contrast to the uncertainties of rainfed agriculture, rice farmers are finishing the harvest probably with record yields, perhaps crossing 9,500 kilos per hectare for the first time..

The market should continue to be pressured by the abundance of soybeans and corn in Brazil and by the progress of planting in the United States, waiting for two key dates: the first projection of world production 2023/24 by the United States Department of Agriculture (USDA) and then on May 18 when the agreement that allows the export of grains from Ukraine, which has been questioned by Russia, can fall.

Weekly closing of markets.

wool rebound

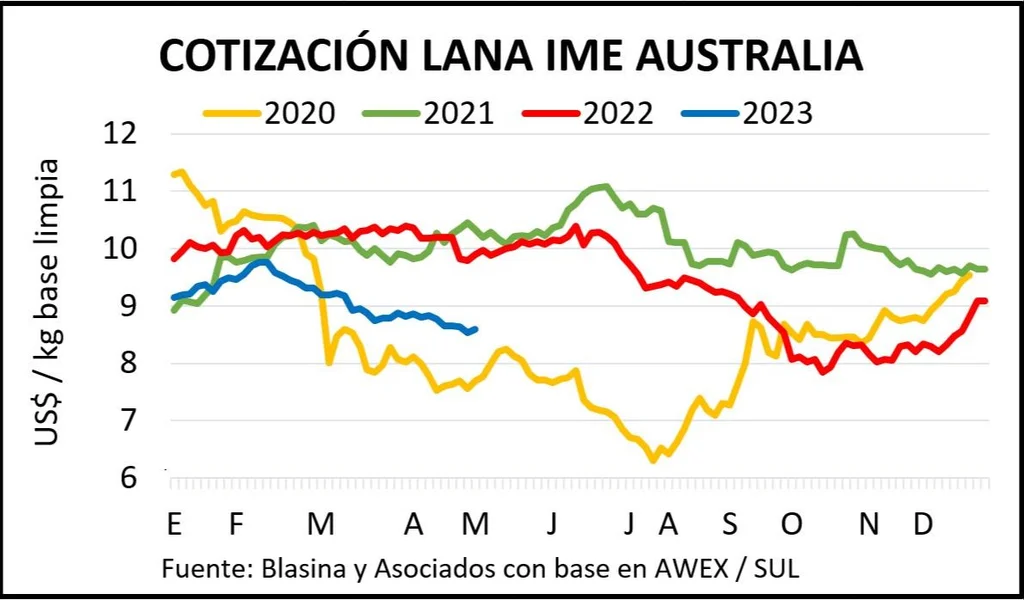

The price of wool has rebounded in Australian dollars over the last week, although the price in dollars lost US$ 0.04 (0.5%) as a result of the weakening of the Australian currency.

The Eastern Markets Indicator (IME) closed at US$ 8.60 on a clean basis with a positive evolution throughout the week.

Weekly closing of markets.

Trading started slowly on Wednesday and things turned around on Thursday, with a more positive outlook on renewed interest from buyers, according to Australian Wool Innovation (AWI).

For the first time in 2023, price increases were registered at Australian auctions for all types and diameters of wool, in local currency.

Wool from 19 to 22 microns was the one that captured the majority of interest from Chinese buyers, as well as the few lots of superior quality fine wool offered, since the proportion of wool with a high vegetable content has increased throughout the year.

Almost 35,000 bales were sold, 91% of a lower offer than last week. The volume offered will grow to 44,257 bales next week.

In the local market, operations continue to be very limited, with a stock of 47 million kilos in the hands of producers, consignees and exporting companies, with no clear destination..

It is mainly Corriedale yarns from 26 microns onwards.for which there is still little demand and excess stocks globally.

The Association of Wool Consignees and Auctioneers did not report sales this week, and the Uruguayan Wool Secretariat (SUL) only consigned an Ideal wool business of 3,000 kilos of 22.8 micron wool conditioned with a green tap at a price of US $4 per kilo fleece.