In 2021, the Municipality of Colonia collected, through UTE, almost 196 million pesos for the Public Lighting tax. This tax was created six years ago, however, during the same year the municipality invested barely twenty-seven million in public lighting.

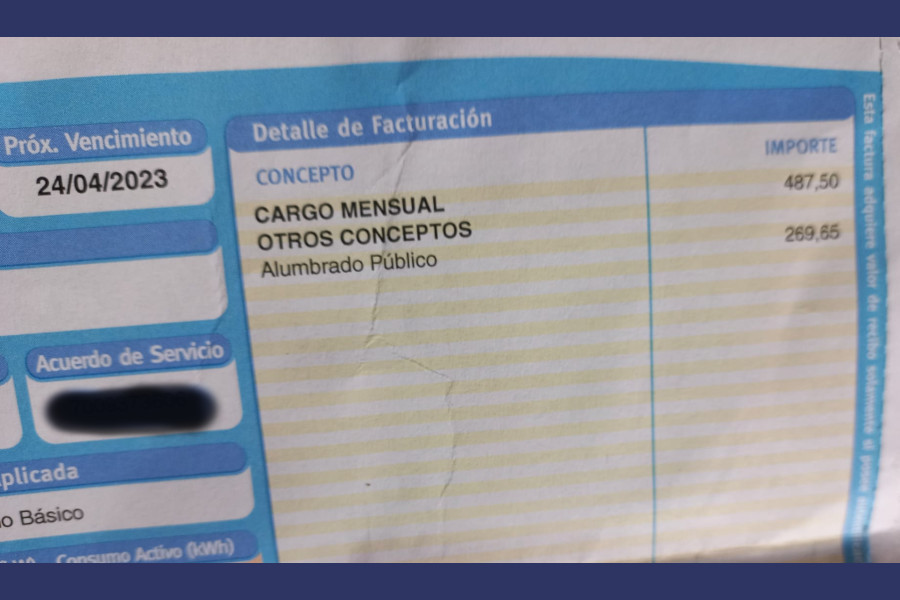

The tax began with bands of 100 (the least), 200 and 300 pesos per month, and it goes up year after year. Currently there are users who pay more than 50% for public lighting than what they consume in the entire month of electrical energy in their home.

In times where the cost of living causes concern, there are outraged users, one told EL ECO: “in the big hand where we live, we are 20 neighbors, and if we add the 269 pesos that each one of us has to pay, the Municipality of Colonia, for month, collect 5,380 pesos from us for 08 spotlights on the block”

The request for reports from the FA

What is done with the 150 million pesos that are “left over”? What are they spent on? Why isn’t more money invested in lighting? Why aren’t the tax amounts reduced? That is the question asked by the councilors of the Frente Amplio de Convocatoria Colonia, which brings together several Frente Amplista councilors.

Point by point

It is requested that you inform the following:

1) How much has the collection for the Public Lighting tax and the respective expense for the provision of the service amounted in these six (6) years since its creation, in general and differentiating for each year (2017, 2018, 2019, 2020, 2021 and 2022).

2) How much has the difference in the aforementioned concepts (tax collection – lighting expense) amounted to in these six (6) years since its creation, in general and differentiating each year (2017, 2018, 2019, 2020, 2021 and 2022 ).

3) What has this difference been spent on in these six (6) years since the creation of the Tax, in general and differing for each year (2017, 2018, 2019, 2020, 2021 and 2022).

4) If as of today the Municipality of Colonia maintains previous debts with UTE -if so, informing how much they amount- or if it was settled and is up to date.

5) What is the number of accountants or users in the department of Colonia that, to date, are taxpayers. In general and detailed for each strip.

6) Why have the tax amounts of the respective bands not been reduced when there is excess collection?

7) What progress has been made in the replacement of current public lighting to LED luminaires. How much it costs to complete the replacement and when it is projected to be completed.

8) The possibility of preparing “special plans” with the remaining money has been considered, in order to install public lighting in areas of the cities that lack this service.