São Paulo,.– After reaching levels in 2021 not seen in a decade, the price of coffee will continue to skyrocket this year and Brazil is partly to blame whose harvest will be limited by adverse weather conditions and logistical challenges related to covid-19.

The global market depends, to a large extent, on the volume of coffee that Brazil is capable of extracting in an unstable scenario, with a tight supply, buoyant demand and the coronavirus pandemic still wreaking havoc on international production chains.

“The prospects for 2022, both in the international market and in Brazil, are of firm prices” with “moderate variations,” agronomist Fábio Costa, an analyst at the National Supply Company (Conab), linked to the Ministry of Agriculture, told Efe. Brazilian agriculture.

You might be interested in reading: How much caffeine is in your coffee?

Brazil has a decisive weight in international coffee prices due to its status as the world’s largest producer and exporter.

In the last decade, about 70% of national production was destined for the rest of the world. What happens in the coffee plantations of this country has planetary repercussions and 2021 was an especially hard year, with a reduction in production of around 25% compared to 2020, when it collected the record of 63 million 60-kilo bags.

The reason?

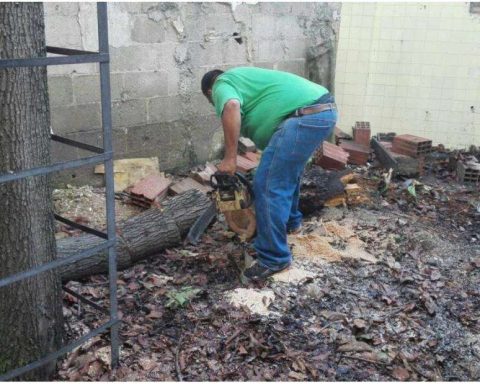

The climatic difficulties faced by the main producing regions, such as the state of Minas Gerais (southeast), including the severe drought that preceded the flowering phase and the subsequent frosts of last southern winter. For Costa, the La Niña phenomenon also contributed to this “rupture” in productivity, in a year that was already expected to be worse due to the very nature of the biannual coffee cycle.

The price escalation, Costa points out, began “in the last quarter of 2020”, with the first signs that the weather would not row in favor, as was confirmed later. In 2021 they continued to rise due to the risk of supply shortages, with the worsening of the weather situation in Brazil.

All this, together with the problems in Vietnam and Colombia, the other major players in the sector, plus rising demand, contributed to the price of coffee on the New York Stock Exchange jumping “74%” in 2021, he stressed to Efe Gil Barabach, consultant for ‘SAFRAS & Mercado’, an entity specialized in Brazilian agribusiness.

Arabica coffee contracts, the most produced in Brazil, traded in New York with delivery in March 2022 settled on December 31 at 226.10 cents per pound (0.45 kilos), the highest level since 2011 .

And in these first weeks of the year the price has continued to rise to 240. By 2022, Brazil expects to collect 55.7 million 60-kg bags, 16.8% more than in 2021, in which it would be the third best vintage of its history, although the result reflects the climatic problems of the previous course.

“The drought limited the growth of the plants in 2021 and now they do not have enough energy to sustain a very large harvest,” analyzes Costa.

The abundant rains that have fallen since October during the flowering phase brought growers some optimism, which faded when they observed that this did not translate into a high volume of fruit.

To read more: Different ways to prepare coffee

Added to the uncertainty about what the real behavior of the Brazilian harvest will be in 2022 are projections that indicate an increase in global consumption, in a context of “logistical chaos” generated by the pandemic, according to Barabach.

The lack of containers or the increase in freight costs has made it difficult to move coffee from exporting countries to the main consumer markets, such as Europe and the United States, which also ended up pushing prices up.

In addition, at the domestic level, the situation could be worse, since, if the appreciation of the dollar against the real continues, Brazilian exporters will be more likely to sell grain abroad to obtain higher profits.

“What will mark the (international) market will be the next Brazilian harvest and the expectation is that there will be a loss of potential,” Barabach remarked. And for 2023 more of the same, as today’s forecasts do not anticipate a sharp drop in future coffee prices.