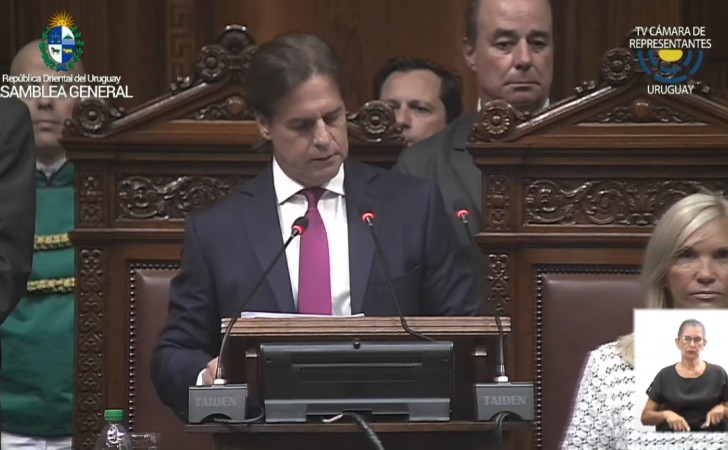

The President of the Republic began the General Assembly on March 2, 2023, recalling that most of his administration was marked by the COVID-19 pandemic, but he argues that he never used the global health crisis “as an excuse” to back down in their governmental goals.

Here are some of the highlights of his speech.

- According to him, Uruguay overcame “the difficulties and we have reasons to believe in the opportunities that our country has ahead of us.”

- On March 27 of last year, he recalled, was the referendum against the Law of Urgent Consideration, returning to his pamphlet that the law is “fair and based on popular demands, full of guarantees” that had “a very long process of analysis and discussion”. “Today more than two years and seven months have passed and behind are the reports of damages and rather there were benefits.”

- The LUC was the “starting point” for the Social Security reform and for the so-called “educational transformation”.

- On the educational transformation, he pointed out: “We have committed ourselves to putting aside the speeches and moving directly to action.” “Children and their families do not believe, they do not see education as a tool for improvement, and that is why we have to get out of our comfort zone. We all somehow have something of a conservative, but if we fall behind from conserving so much, it is an obligation to get out of our comfort zone ”.

- He promises to multiply the Espínola Centers in 2023.

- “During 2022, the school feeding system was increased and professionalized.”

- “This year the salary recovery for civil servants (of education) and teachers began.” “Educational transformation is underway.”

- “The unemployment rate is lower than it was before the pandemic”

- The president defends the regulation of legal status for social and union organizations.

- “I do not want to stop overlooking, in 2022, about 40,000 jobs.”

- Regarding retirement, he said that we need a “fairer system” because we are going through “an aging process because we live longer and better.”

Lacalle Pou announces reduction of personal income tax and IASS

In his speech, the right-wing president recently announced a tax cut in the South American country, which will mean a tax waiver of 150 million dollars. The measure will affect 63,000 taxpayers who will stop paying Personal Income Tax (IRPF) and 20,000 who will stop paying Social Security Assistance Tax (IASS).

As explained by the president in his speech before the General Assembly, the objective of the measure is to increase people’s disposable income by increasing deductions, especially focused on income taxpayers with lower incomes and workers with dependent children. . Lacalle Pou affirmed that he is convinced that, in addition to those directly benefited, the measure will generate a virtuous process of greater consumption and economic dynamism.

The president explained that, thanks to the economic policies carried out by the Government, which include increased employment, economic growth, balanced finances and compliance with fiscal goals, they are in a position to proceed with a tax cut for those people who make great efforts to support themselves financially and who generally do not have full support from the State because they are not in a vulnerable situation.

The first concrete measure will be the increase in deductions for workers who pay personal income tax with lower incomes and those who have dependent children. The deductions will become 14%, compared to the current 10%, for taxpayers who have a net monthly income of up to $60,500. In addition, the deduction per dependent child will be increased from 13 BPC to 20 BPC ($113,200 per year) and the duplication will be maintained in the case of children with disabilities.

On the other hand, there will be an increase in the ceiling for the cost of housing to acquire to access deductions for mortgage credit, reaching around US$ 137,500, and an increase in rental credit, from 6 to 8%.

According to Lacalle Pou’s estimates, these personal income tax deductions will benefit 75% of the taxpayers of this tax, and 14%, about 63,000 people with lower incomes, will stop paying said tax. The fiscal cost of this measure is estimated at US$ 80 million.

Regarding the IASS, the president announced that the range for the collection of the retirement tax will be increased, from 8 BPC to 9 BPC, which will mean that the minimum non-taxable amount will be $50,940. There will also be an increase in the lease credit, which will become 8%. These measures will have a fiscal cost of US$30 million and will benefit all IASS taxpayers, while 20,000 will stop paying the tax.