On January 1, the tax reform promoted by the Government of Gustavo Petro entered into force, with which It seeks to raise some 20 billion pesos to finance social programs in the country.

(Universal declaration of income: what it is and how Dian would lead it).

This reform began in the midst of an uncertain economic outlook that could have an effect on taxpayers’ pockets.

According to Scotiabank Colpatria, due to the tax reform, companies are going to have to balance their budgets, taking into account a scenario of higher taxes for this year.

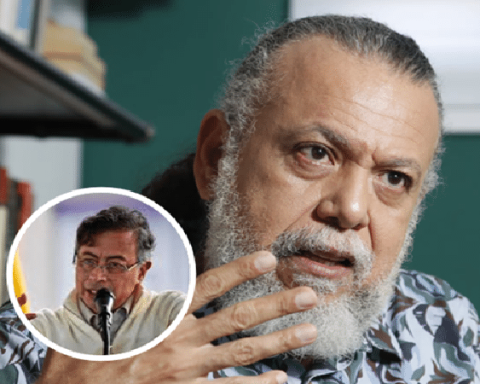

However, for the director of the Dian, Luis Carlos Reyes, the effects will not be serious since according to him, “The vast majority of companies in the country, or they will not see an increase in their taxes or they will see a reduction.”

“In the simple regime, which the vast majority of companies in the country can take advantage of, lowered their rates in all categories, and is designed for small and medium-sized companies. There are many companies that would benefit from being part of the simple regime in terms of effective rates and have not joined. One of the things we want to do is to continue promoting this tax scheme, which, as its name indicates, has fewer procedures than the ordinary regime and represents a lower level of taxation for a significant part of the companies. And those who cannot take advantage of the simple regime, the vast majority, will not see any change, except for a small benefit that was the discount of the ICA of the income tax ”, said the director of the Dian in an interview with Portafolio.

(Dian: his projections of tax collection and electronic invoicing).

According to Reyes, the effects on the economy will not be great since the debate centered around some sectors, to which it is true that taxes were raised, but it was never intended that these sectors leave the country.

“There is an overtax for the financial sector, energy mining, and electricity generation, which are simply sectors that can contribute more and that even in this new tax system continue to be an attractive and viable business option”he added.

(Do you have debts with Dian?: so you can ask for discounts in 2023).

According to him, the economy is a very complex system and whatever one does to a certain degree has an impact on absolutely everything.

“I think none of the tax reform measures are even close to generating inflationary pressure that is even noticeable in people’s day-to-day lives, much less a reason for concern in general,” concluded.

BRIEFCASE