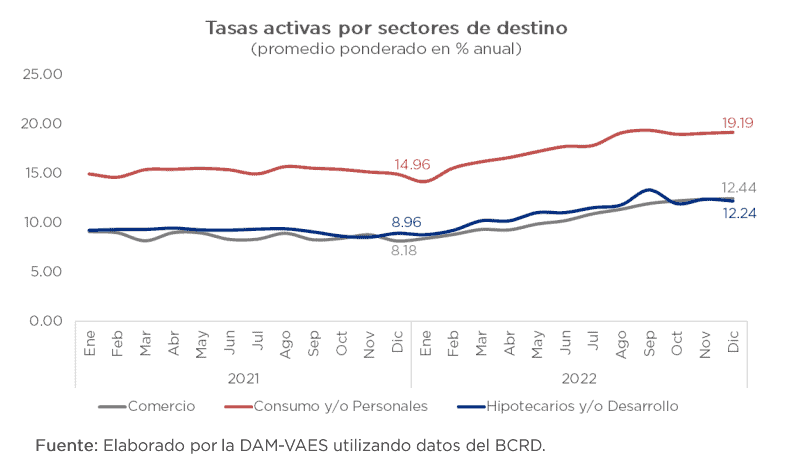

The tighter monetary policy applied by the Dominican monetary authorities throughout the 2022caused them to register higher interest rates Compared to those of 2021, the one destined for businesses was the one that varied the most.

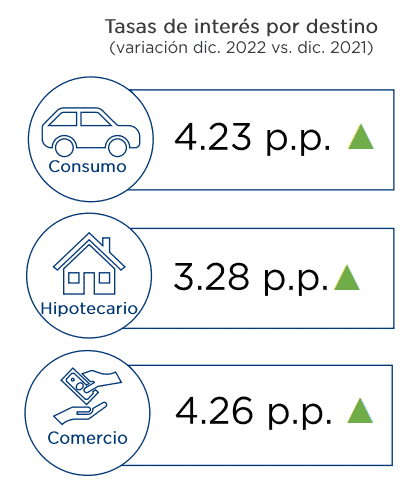

The interest rate for the shops increased 4.26 percentage points, going from 8.18% in December 2021 to 12.44% in December 2022, reports the Ministry of Economy, Planning and Development in its most recent report on the macroeconomic situation.

The second rate that varied the most was that of consumer and personal loanswhat happened from 14.96 to 19.19%for an increase of 4.23 percentage points.

The rate that varied the least was the interest rate of the mortgage loans: 3.28 percentage points.

In just one year, the Central Bank of the Dominican Republic brought the monetary policy interest rate to 8.50% per year, leaving it at the latter percentage in the last two months. The first increase occurred in November 2021, when it took it to 3.50%.

When the Central Bank raises its rate, this has a gradually increasing effect on the different types of credit products. credit and deposit in the local financial system.

Loans by economic sector

The Ministry of Economy indicates in its report that the loans intended for private sector increased 16.7% in December, “a behavior driven mainly by the increase in loans to the productive sectors of the economy and to consumption, which together explain 72.8% of the observed variation.”

The mortgage loans represented 18.7% of the change.

Among the productive sectors, it stands out Commerce (more than 36,000 million pesos), microenterprises (more than 18,000 million) and farming (over 12,000 million), with the largest absolute increases in the period.

card transactions

The volume of transactions by all means, made with credit and debit cards, reached the 42.7 million pesos in November 2022, for a year-on-year increase of 9.9%, reports the Ministry of Economy.

The internet transactions grew 2.2%, while those carried out in points of sale They continue to be the largest and registered an increase of 14.2% in the aforementioned period.