Probably the worst in terms of inflation is over.

At least that is what the consensus of economists and the main economic organizations such as the IMF or the World Bank thinks after most of the world’s countries experienced in this year that we left behind price rises not seen in four decades.

There is no doubt that inflation will continue to hurt the pockets of millions of citizens in 2023, but it will take a general breath with a slow trickle down over the next 12 months.

By the end of that period, the International Monetary Fund expects global inflation to have fallen to 4.7%, just under half its current level.

Of course, experts warn, what is happening in each of the world’s major economies is different.

What is happening in Europe is not the same as in the United States or the rest of the advanced economies or in the emerging countries.

But many seem to agree that global GDP growth will continue to slow and inflation has peaked.

However, it will remain at high levels, in a context that many have renamed the “new normal”.

“Everything indicates that inflation in 2023 will moderate, although it will continue to be higher than before the pandemic,” Juan Carlos Martínez Lázaro, professor of Economics at IE University, explained to BBC Mundo.

“We will not see an abrupt fall. The price of oil has fallen, but it remains high. The same as raw materials and there are still certain problems in global supply chains,” recalls Martínez Lázaro.

“Therefore we expect that in 2023 the average inflation rates will be lower than those seen in 2022. But of course it will take time and it will not be in 2023 when it will be possible to return to pre-pandemic inflation levels. To reach that scenario It’s still months away.”

In fact, US Federal Reserve officials believe that it will take until 2025 for inflation to return to the institution’s target of around 2%.

“Many of the market pressures that hit in 2022, such as skyrocketing energy prices, the general cost-of-living crisis, tax and interest rate hikes have not yet had their full impact,” says Álvaro Antón, head of Iberia for the investment firm Abrdn.

That is why he believes that although there will be regional and national variations, it is likely that “headline inflation in most developed markets will peak in late 2022 or early 2023,” he adds.

The other point on which economists agree is that the slowdown in inflation will be linked to the slowdown in growth, which will cause pain for households on another side.

In the end, if families have to pay more for everything, what happens is that they can buy less, they can spend less on other things like trips or new cars.

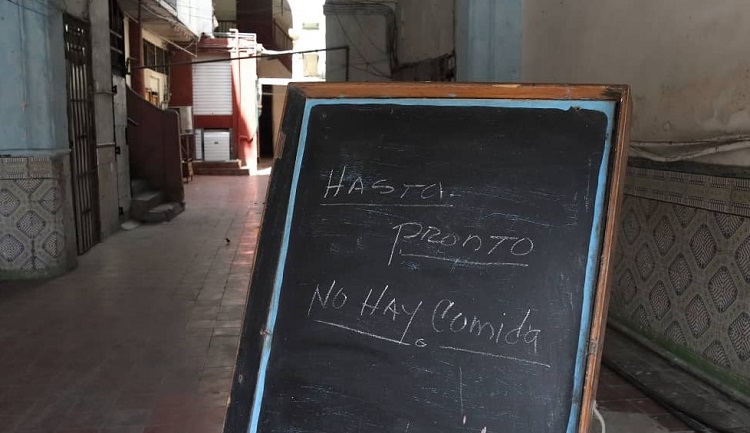

Especially if what we are talking about is paying more for basic items such as food and energy, which is where the strongest price increases are concentrated.

If we add to this the fact that most central banks have tightened their monetary policy significantly and have raised interest rates, this translates into less consumption by families and less activity by companies.

This last point is the one that can trigger unemployment and drag prices down.

“Technical recessions are likely to occur in multiple economies during 2023, which will cause global growth to fall below its potential to 2.6%, from 3.3% in 2022,” they forecast in Scope Ratings.

However, from the credit rating agency they rule out that there will be a serious recession in the world or that we will witness a global financial crisis next year.

In this environment, with the war in Ukraine and geopolitical tensions heightened, with covid spreading across China, the UK facing a winter of strikes and a cold snap in Europe, economic contraction will be very difficult to avoid.

“My forecast for the US is recession. It has to have one. Its current job market is tighter than ever in a post-war period and surprisingly it hasn’t weakened,” says Steven Bell, the firm’s chief EMEA economist. Columbia Threadneedle in an interview.

His opinion is shared by other experts. To cool inflation in the United States, they say, it is necessary for the labor market to take a breather.

“I think they need a recession. I don’t think it will be deep. It will be mild and the response will be quick, but I think they need it. And Europe is going to have one too because of the incredible increase in energy prices,” Bell adds.

“And we must not forget that a recession in developed countries generally leads to a recession in emerging markets,” says the economist.

A designation that often includes several Latin American countries.

But despite the drop in the prices of raw materials, especially oil, the agreement to export grain from Ukraine that gave a break to food inflation and despite the rise in interest rates, measures all designed to break to inflation, there are also those who prefer to remain more skeptical of the forecasts for 2023 on inflation.

“There is a risk that inflation will not fall as the consensus expects. In fact, the fact that it is what is expected almost unanimously is worrying because the consensus of analysts is more often wrong than right,” says Víctor Alvargonzález, director of strategy and partner founder of the independent advisory firm, Nextep Finance.

In fact, 2022 is a clear example of how much reality can deviate from economists’ forecasts.

At the beginning of the year, the main organizations affirmed – almost unanimously – that the double-digit inflation that was already registered in many economies was “transitory”. Nothing is further from reality.

“This inflation may turn out to be much more persistent than people expect,” says Bell.

Another danger that could derail the expert consensus is that the war in Ukraine could get out of hand.

“We are in an indirect confrontation between NATO (through the Ukrainian army) and a nuclear power, Russia, so the longer the war lasts, the greater the risk of accidents or war escalations,” says Alvargonzález.

Another negative force that is there, in the shadows, is the hidden confrontation between China and the United States for global power.

“Right now the US is busy with Russia, but sooner or later it will realize that its biggest problem is China, which is actually taking advantage of the situation created by the invasion of Ukraine. Just look at Xi Jinping’s latest visit to Saudi Arabia and how it was received,” says the Nextep Finance economist.

Remember that you can receive notifications from BBC Mundo. Download the new version of our app and activate them so you don’t miss out on our best content.