The fact that the Dominican Republic has one of the largest and most resilient growing economies in Latin America has a lot to do with the leading role that its Central Bank has played in the last two decades.

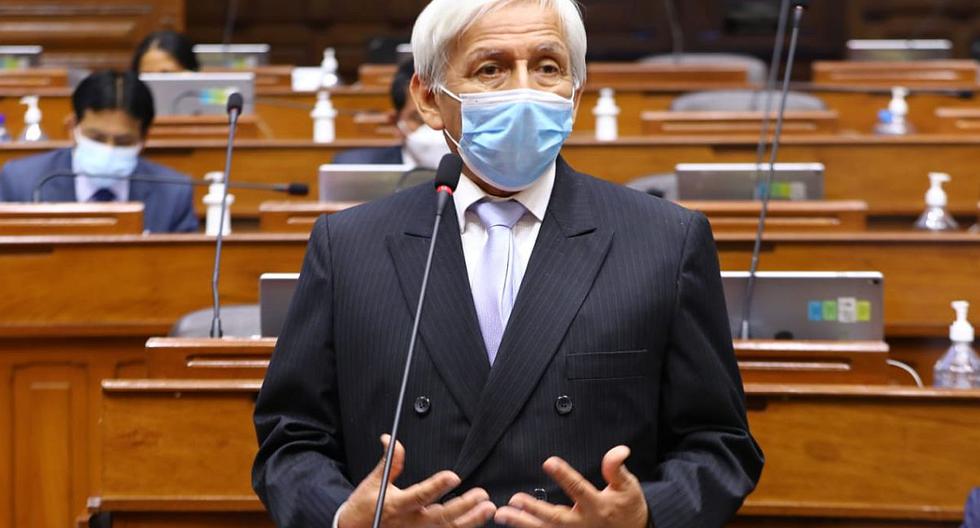

Behind the country’s average annual growth of 6% and its low and stable inflation, there is one person who stands out: Héctor Valdez Albizu, Governor of the Central Bank from 1994 to 2000 and again from 2004 to the present. “I have been governor of the Central Bank for 23 years and in some way that has helped to create an environment of certainty for investors,” says Valdez Albizu in a report/interview for Khaleej Times magazine, from the One World Media group.

Héctor Valdez Albizu highlights that the main achievement of the institution, the mandates of the current governor of the BCRD, have been the efforts aimed at preserving macroeconomic stability. “It has been a long process with some potholes,” recalls the official.

The publication cites that “although in the 1994-2000 period the bank managed to overcome its liquidity management problems and bring economic stability to the country, the main challenges came later, between 2003-2004, when a series of bankruptcies translated into a major economic crisis that cost the country around 20% of its gross domestic product (GDP)”.

“When I again assumed the governorship of the Central Bank in August 2004, we had to face the effects associated with the largest bank fraud in the history of the Dominican Republic. It led to a systemic financial crisis that caused capital outflows, inflation, a drop in GDP and negative international reserves,” Valdez recalls.

However, as a testament to its resilience, the Central Bank managed not only to recover, but also to reap some benefits from that crisis. In the first place, 18 regulations of the Monetary and Financial Law were approved, strengthening the prudential norms in the financial system. These standards allowed the country to restore its financial position, and as of 2004 the regulation and supervision of the Dominican financial system was strengthened. The economy resumed a path of growth and stability, and confidence in economic agents and international investors were key in this process.

payment systems

The report refers to the creation of the most efficient and dynamic payment systems in the region. He mentions that the agency implemented the Inflation Targets scheme, which has made it possible to reduce both the level and the volatility of inflation, providing certainty to the private sector.

Khaleej Times magazine highlights that in 2019 the Central Bank implemented a Foreign Exchange Trading Platform, which has allowed efficient and transparent management of its foreign exchange operations and other financial intermediaries. “Currently the Central Bank is strengthening its cybersecurity and that of the financial system as a whole, through the creation of a modern Sectoral Center for Response to Cybersecurity Incidents (…)”, the letter indicates.

And he adds that “with timely measures and strategic management, they have managed to turn the country into one of the most attractive business destinations in the region.”

It also cites the extraordinary measures for extraordinary times and to mitigate the effects of the covid-19 crisis on households and productive sectors that the monetary authority ordered, especially towards micro-enterprises and other businesses.

“The Central Bank responded quickly with monetary easing measures that have proven to be quite effective. The monetary policy rate was reduced by 150 base points, reaching a historical low of 3.00% per year, with which the active interest rate went from 13.28% in March 2021 to 9.69% in October 2021. Likewise, a program was implemented of liquidity provision of approximately 5.0% of GDP, which allowed them to channel about 92 thousand loans and debt restructurings through financial intermediaries”, says Khaleej Times

Likewise, the Monetary Board ordered a transitory regulatory measure to moderate the impact on the financial system and encourage access to financing, including maintaining the risk classifications of debtors and provisions unchanged at pre-pandemic levels. Similarly, the Central Bank managed the disbursement of US$650 million through the ‘Fast Credit Facility’ of the International Monetary Fund to mitigate the impact of the pandemic on the most vulnerable

As a result of the accelerated recovery of the economy, supported by these monetary and fiscal measures, since August 2021 there is a gradual return of the resources provided through liquidity programs as companies and families pay their loans at maturity. .

“Now in a second stage, the Central Bank has increased its monetary policy rate by 50 basis points in November 2021; this ensures that inflation converges to its target range over the monetary policy horizon and that inflation expectations remain anchored,” he maintains.