Ruiz, president of the ABA, specified that this figure is much higher if the large investments made by banks in digital transformation are taken into account.

The Dominican multiple banking has invested more than RD$3.4 billion this year in actions to prevent money laundering and in cybersecurity For the users.

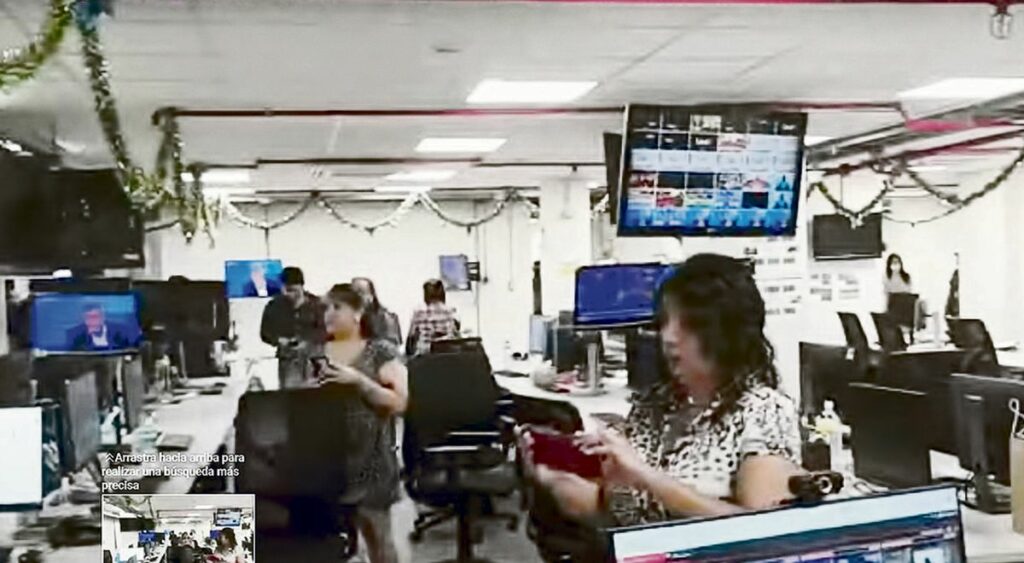

When offering the figures, the president of the Association of Multiple Banks of the Dominican Republic (ABA), Rosanna Ruiz, explained that in 2022 they allocated more than RD$1,945,711,589.87 of their budget to the strengthening and consolidation of the money laundering prevention system, which translates into greater endowment of resources that support its execution and more sophisticated and efficient controls.

While more than RD$1,500 million were invested in cybersecurity actions for banks and education for users, so that they avoid being victims of cybercriminals.

Ruiz specified that this figure is much higher, since since 2005, when the modernization of the payment system began with the support of the World Bank, the bank has made large technological investments and today it is 100% digitized.

“In addition, there are investments in changes to internal models such as the banking CORE that is changed once or twice in 50 years and that carries costs of more than RD$3,000 million,” Ruiz explained during a meeting of ABA executives with the media.

We invite you to read: Indigent or alienated: what does the Penal Code say about the person who threw the stone at 27?

In the activity, the ABA regulation manager, Lidia Ureña, explained that the bank develops the Anti-Money Laundering and Counter-Financing of Terrorism Compliance Program (AML/CFT) and it has more than 413 collaborators specialized in the compliance function, dedicated to ensuring the faithful execution of this program.

He stated that another of the essential pillars of the program is the training of personnel and in this sense, during 2022 the commercial bank has provided more than 27,200 hours of specialized training in the prevention of asset laundering and terrorist financing to its collaborators at all levels, from its Board of Directors, senior management, business executives and other support areas.

And as of November 2022, multiple banking managed about 1,047,132 alerts, that is, transactions that deviate from normal behaviors. Of this total number of alerts, 3,322 Suspicious Operation Reports (ROS) have been generated.

Likewise, in compliance with its role as a subject subject to commercial banking until November 2022, the Financial Analysis Unit (UAF) sent an approximate of 428,725 Cash Transaction Reports (RTE).

In another order, also during January-October private credit increased by 8% compared to the same period in 2021. And in the first 10 months of 2022 private credit increased by more than RD$140 billion and since the pandemic technical equity of the banks has a growth of 50%, RD$90 billion.