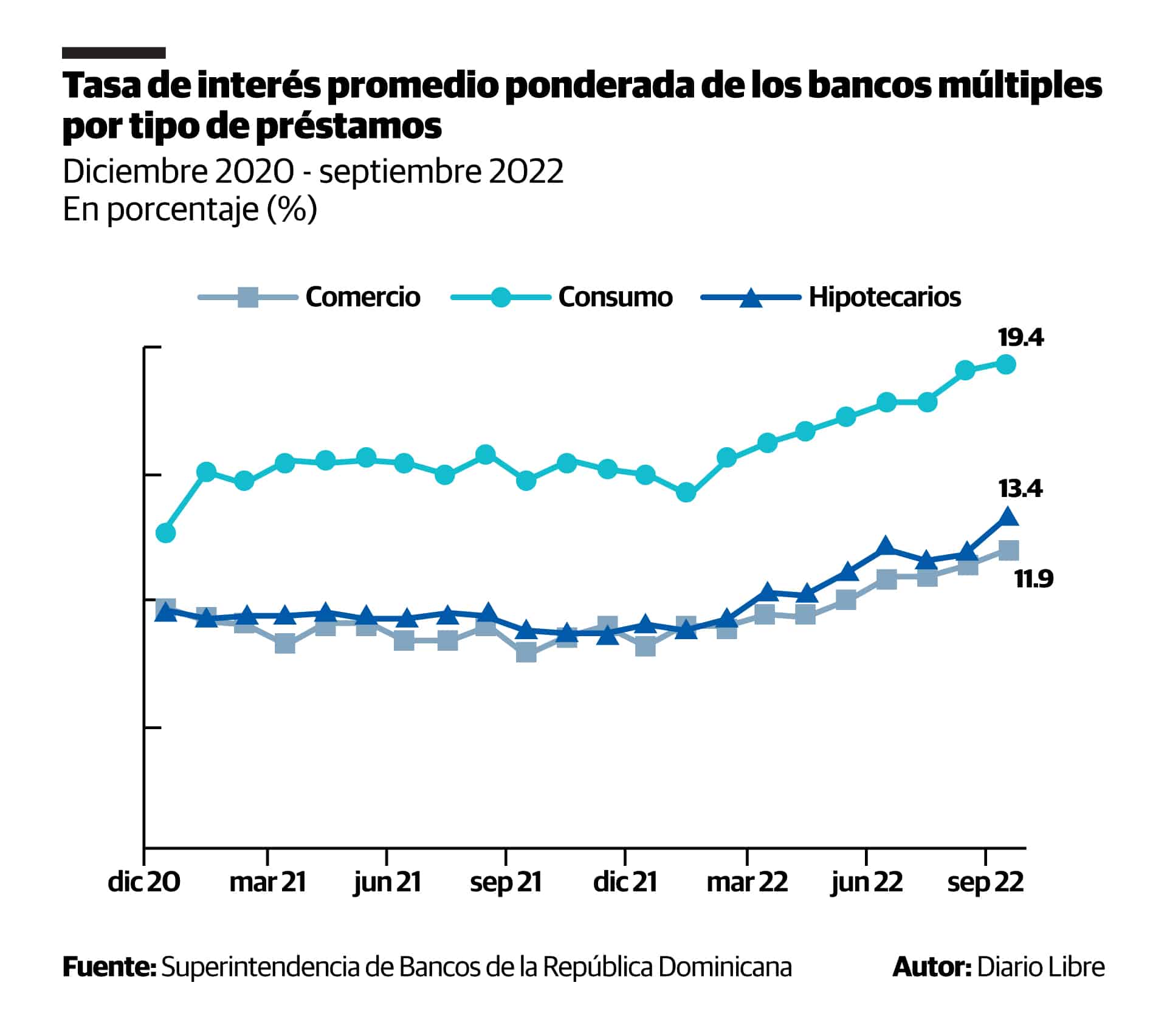

The interest rates of banking products continue to rise given the national and international macroeconomic context, but the Superintendence of Banks reports narrowing margins.

In its most recent quarterly report on the performance of the financial system as of September 2022, the institution reports that the interest rate consumer loans Registration increments compared to the previous quarter to establish itself in 19.4% per year.

Indicates that the business rate also observed an increase in relation to the previous quarter, registering 11.9% To september.

He adds that the mortgage loans similarly, they presented an increase in their rates, going from 12.1% in June 2022 to 13.4% in September.

Additionally, it verified an increase in the interest rate of the Credit cards in national currency of +1.6 with respect to its level of the previous year, going from 56.2% in September 2021 to 57.8% to September 2022.

The Superintendence of Banks notifies that the weighted average interest rates Multiple banking assets and liabilities closed in June with levels of 13.7 and 8.3%, (+4.5 and +6.0 percentage points since December 2021), respectively.

Between the end of 2021 and 2022, the Central Bank maintained a restrictive program to contain the inflationwith the consecutive increase in the interest rate of monetary politicswhat happened from 3.50% per year in November 2021 until paused in 8.50% per year in November 2022.

Once the Central Bank increases its interest rate of monetary politicsthis results in an increase in the interest rates gradually in the different types of credit and deposit products in the financial system, depending on whether they are contracted at a fixed or variable rate, explains the Association of Multiple Banks of the Dominican Republic.

Impact on solvency

In its report, the Superintendency of Banks indicates that the system solvency reflects the impact of the increase in the volatility of the interest rates.

As of September, he reports that the solvency ratio of the financial system presents a slight increase in relation to the second quarter, standing at 17.29% (1.0 percentage point).

The capital required by market risk it came to represent 103.6% of technical equity in the third quarter of the evaluated period, and this indicator was 124.5% last quarter.

In the quarterly report, the Superintendence indicates that the Finance system Dominican remains stableresilient and with an adequate capacity to absorb losses, presenting adequate levels of profitability, solvency and liquidity to respond to changes in market conditions and the economic situation.