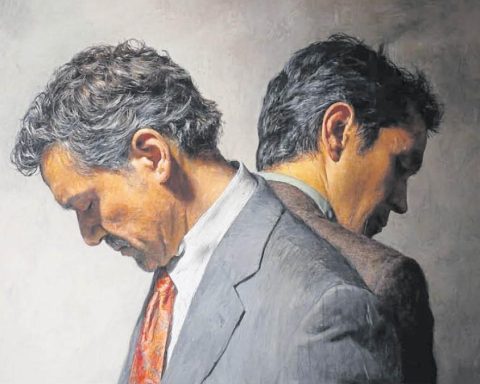

The Federal Reserve of the United States (FED) decided this Wednesday, in Washington, to maintain its reference interest rate in a range between 0% and 0.25%, although its president Jerome Powell admitted that inflation could accelerate and that this could determine that in the coming months there is a correction.

The US central bank also announced that it will begin to reduce purchases of toxic assets from March.

In a statement, the FED reported that “the Federal Open Market Committee (FOMC) decided to maintain the target range for the federal funds rate between 0 and 0.25 percent. With inflation well above 2 percent and a strong labor market, the FOMC expects it will soon be appropriate to raise the target range for the fed funds rate. The FOMC decided to further reduce the monthly pace of its net asset purchases, culminating in early March.”

The agency indicated that “beginning in February, the FOMC will increase its holdings of Treasury securities by at least $20 billion per month and of agency mortgage-backed securities by at least $10 billion per month.”

Powell, in a press conference after the Federal Committee meeting, said that there is “the risk that inflation will not return to pre-pandemic levels in the short term”, and acknowledged that “price increases could accelerate.”

“Inflation risks are still to the upside in the view of most FOMC participants, and certainly in my view as well. There is a risk that the high inflation we are seeing will continue. There is a risk that it will go even higher.” So we have to be in a position with our monetary policy to address all plausible outcomes,” Powell said when answering questions.

The head of the FED stated that “Controlling inflation is itself vital to a strong labor market. The best we can do to support continued labor market gains is to promote a prolonged expansion, and that will require price stability.”

“I believe that there is plenty of room to raise interest rates without threatening the labor market, as the Fed’s ultimate focus is on the real economy,” Powell stressed.

The president of the Fed remarked that “in light of the remarkable progress we have seen in the labor market and inflation that is well above our long-term objective of 2%, the economy no longer needs sustained high levels of support of monetary policy.

The official explained that “Wages have also increased considerably, and we are alert to the risks that persistent growth in real wages, above productivity, could put upward pressure on inflation.”

Powell stressed that “this is why we are phasing out our asset purchases and hope that it will soon be appropriate to raise the target range for the fed funds rate,” Powell added.

In relation to future interest rate movements, the FED statement points out that “in assessing the appropriate monetary policy stance, the FOMC will continue to monitor the implications of incoming information for the economic outlook. The FOMC would be prepared to adjust monetary policy stance, as appropriate, if risks arise that could impede achievement of targets FOMC assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and expectations of inflation, and financial and international developments.

Regarding future monetary policy, the committee left a trail of considerations among which it mentions that “changes in the target range for the federal funds rate are its primary means of adjusting the monetary policy stance.”

“The FOMC will determine the timing and pace of reducing the size of the Fed’s balance sheet adjustment, to promote its maximum goals of employment and price stability. He expects that the reduction in the size of the balance adjustment will begin after the process of increasing the target range for the fed funds rate has begun.”

The committee later said that it “intends to reduce the Fed’s holdings of securities, over time in a predictable manner, primarily by adjusting reinvested amounts of principal payments received from securities held in the System Open Market Account (SOMA)”.

Over time, the FOMC “intends to maintain securities held in the amounts necessary to implement monetary policy efficiently and effectively in its ample reserve regime,” it said.

In the longer term, the FOMC intends to hold mainly Treasuries in SOMA, thereby minimizing the effect of FED holdings on the allocation of credit across sectors of the economy.”

Next line, the Federal Committee noted that it “is prepared to adjust any of the details of its approach to downsizing the balance sheet in light of economic and financial developments.”

In its diagnosis of the economic situation, the FED stressed that “economic activity and employment indicators have continued to strengthen. The sectors most affected by the pandemic have improved in recent months, but they are being affected by the recent strong increase in cases of Covid-19. Job creation has been solid in recent months and the unemployment rate has dropped substantially.”

In reference to inflation and the dynamics of activity, the Fed considered that “supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to high levels of inflation.”