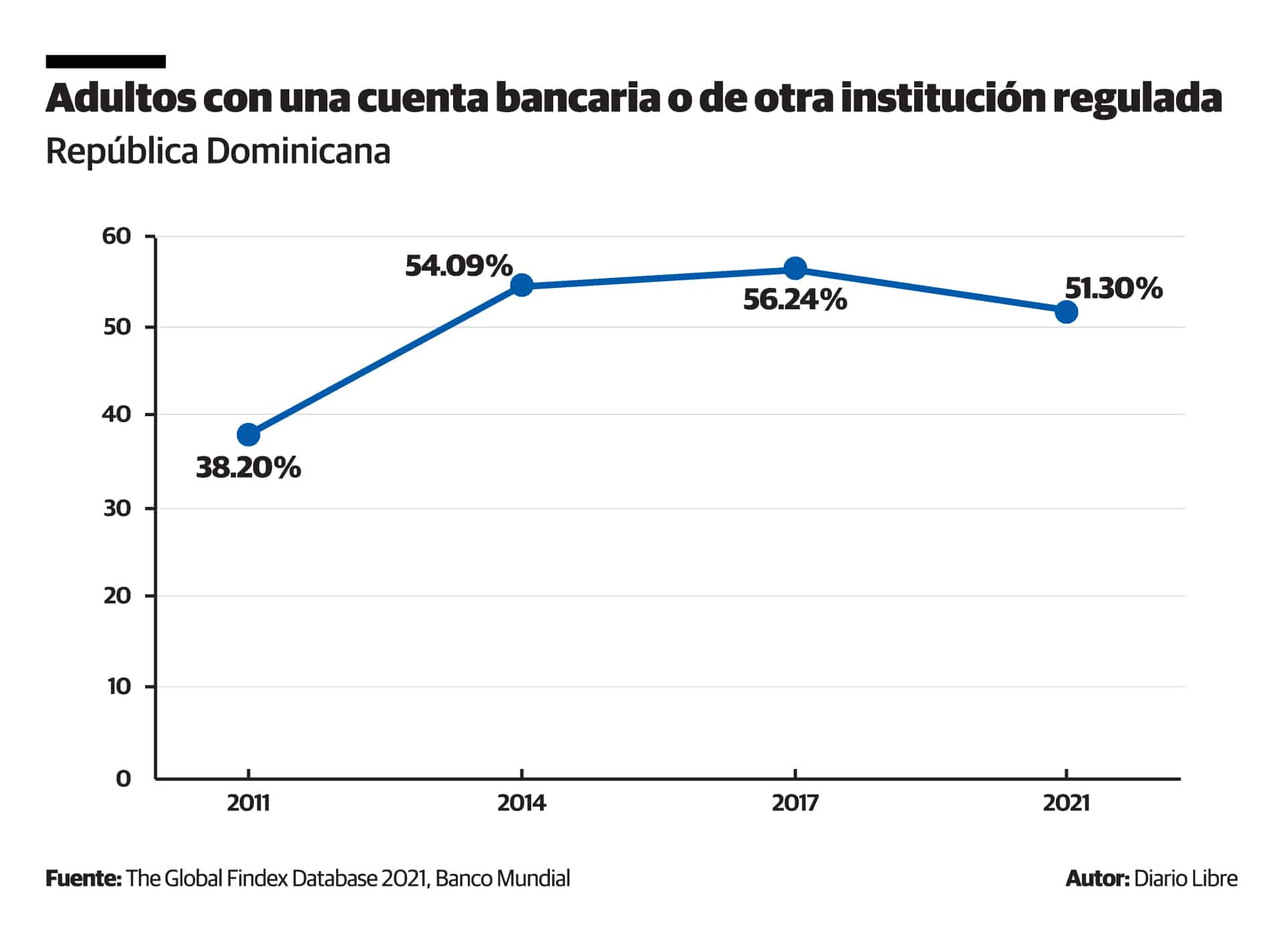

The Dominican Republic had one growing trend in the measurement of world Bank about the amount of adults with a bank account or from another regulated institution. However, in the most recent version of that measurement, the percentage regresseda fact that Superintendency of Banks attributed to the methodology to collect the data.

The world Bank elaborates the Global Findex Databasein which he covers the ways in which Adults all over the world use financial serviceswith the results of the first survey published in 2011.

By 2011 it was found that the 38.2% of adults in the Dominican Republic had an account in a bank or in a regulated institution, a percentage that increased to 54.09% already in 2014 56.24% in 2017.

But the percentage dropped to 51.3% in 2021placing the country under from Brazil and Venezuela (both 84%), Argentina (72%), Bolivia (69%), Costa Rica (68%), Ecuador (64%), Colombia (60%) and Peru (57.5%).

In 2014, the world Bank reported 3,253,470 Adults unbanked in the Dominican Republic, for 46%. That number dropped to 3,251,818 in 2017, for 44%. However, by 2021, it increased again to 3,833,485for 49%.

A matter of methodology?

The Superintendency of Banks attributes the decrease from holding accounts to a matter of methodology.

“Since before the most recent version of the Global Findex we have held several meetings with the authors of the study, trying to understand the reasons for the result and implemented actions to reverse it with a view to future measurements”, replied the Superintendence of Banks a Free Dailyvia its Communications Department, when requesting its opinion on the drop in the variable.

“It is important to highlight that the methodology of said report is based on surveys carried out in each country not in statistics harsh on the number of existing accounts”, he observed.

The world Bank explains in the report that the indicators in the database Global Findex 2021 are drawn from surveys covering almost 128,000 people in 123 economies.

The survey for this recent edition was carried out during 2021 by Gallup, Inc., as part of his Gallup World Poll. The target population is the entire non-institutionalized civilian population 15 years of age and older.

The Superintendency of Banks recalled that in 2022 the implementation of the National Strategy for Financial Inclusion (ENIF), led by the Central Bank, and of whose commission the entity is a member, together with the superintendencies of Pensions, the Stock Market and Insurance.

“This strategic plan takes as its starting point the National Survey of Financial Inclusionconducted in 2019, which yielded an account holding index of 44.9%. As you see, the gap between the two reports is wide,” he said.

Highlight indicators

The Superintendency of Banks highlighted that some of the own indicators associated with the topic outline a rebound in the financial inclusion in the country in the last two years.

“It stands out – he said – the recovery of the number of people with credits in the formal financial system (which saw a reduction during the pandemic). Likewise, the authorization of basic accounts, the remote linking of accounts (onboarding digital) and the accounts of electronic paymentwhich we hope translates into greater formal access to the financial system for all people”.

He advanced that the second delivery from the National Survey of Financial Inclusion will allow a more in-depth assessment of the evolution of the financial inclusion in the territory.

According to the Global Findex Database 2021, worldwide account ownership increased 50% in the 10 years from 2011 to 2021, from 51% of adults to 76%.

From 2017 to 2021, the average account ownership rate in developing economies increased by eight percentage points, from 63% of adults to 71%.

In addition, the gender gap in account ownership in developing economies has narrowed to six percentage points from nine percentage points, where it stood for many years.