The academic union maintains that a law aimed at the coordination and harmonization of state and municipal legislative powers, should not delegate to administrative bodies of the National Executive Power the unilateral exercise of the functions directed to those objectives, but only to their technical implementation.

The Academy of Political and Social Sciences made a public call to the pro-government National Assembly and especially to the members of the legislative commission that is examining the Tax Harmonization bill, so that they “democratically receive the participation of all sectors of the country”, organizations, unions, associations and tax experts, interested or endowed with knowledge in the matter, in order to achieve a legislative instrument according to the needs of the country.

He pointed out in a statement that the project of the Organic Law for the Coordination and Harmonization of the Tax Powers of the States and Municipalities “must start from the notion of tax system invoked in article 316 of the Constitution, with a unifying and synchronizing projection of the multiplicity of taxes created by all three territorial political levels of the Public Power”.

The Academy rejected the so-called dynamic unit of account, that is established in the project, which is intended to be a reference for the updated calculation of the bases of taxes, accessories and sanctions, with the adoption of the highest value foreign currency, although payment in bolivars is foreseen.

«This alleged adjustment (i) distorts the tax obligation, turning it into an obligation of value; (ii) implies a multiple form of adjustment of the tax liability that distorts the effective economic capacity of taxpayers; (iii) ignores the use of the bolivar as: (a) legal tender for the denomination of taxes and; (b) functional currency of the country’s economic environment of taxation and public finances. All this, in violation of articles 316, 318 of the Constitution, 146 of the Organic Tax Code and 117 of the Law of the Central Bank of Venezuela,” the statement said.

*Read also: Conindustria delivered to the AN observations on the draft Tax Harmonization Law

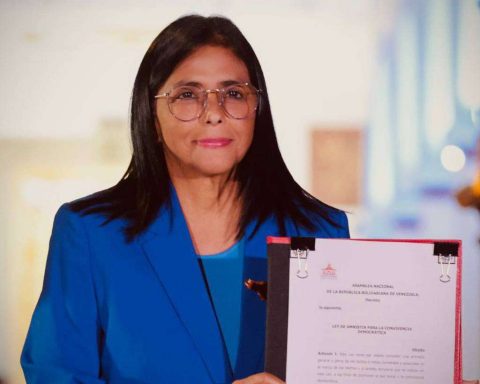

Recently, the president of the Permanent Commission for the Economy, Finance and National Development, Deputy Jesús Faría, announced that the bill should enter into force as of January 1, 2023.

He affirmed that the AN continues to systematize the contributions of all the sectors that participated in the public consultation and declared that they will speed up the preparation of the report for the second discussion and aspire to deliver it next week to the Board of Parliament to debate it in full Chamber.

Faría assured that the legal norm will strengthen local and regional governments in their collection capacity, in order to increase their income, make investments in their geographical space and advance in a national tax system.

However, in the opinion of the Academy of Political and Social Sciences, they should not be left out of the coordination and harmonization measures that the national legislator must adopt, those aimed at rationalizing, making compatible and modernizing the tax regulations applicable to the hydrocarbons sector, with a view to generating maximum legal certainty and real incentives in a priority area in the reactivation of the national economy.

It also argued that a law aimed at coordinating and harmonizing state and municipal legislative powers should not delegate to administrative bodies of the National Executive Branch the unilateral exercise of functions aimed at those objectives, but only their technical implementation.

*Read also: Bill does not order or eliminate the municipal, state and national “tax maelstrom”

Post Views: 271