Mining companies may find new markets for Nicaragua’s gold exports if the United States decides to rigorously enforce modifications a executive order 13851for sanction the Nicaraguan mining industryhowever, its share price has yet to recover on the stock market after the crash.

In 2021, gold was consolidated as the country’s first export product, selling 15.7 metric tons in international markets, obtaining revenues of 880.5 million dollars. Three quarters of those exports had United States as a destination. Data from the Center for Export Procedures (Cetrex), show that as of last September, the country had sold gold for USD 708.8 million, which is 7.95% higher than the USD 652.5 million placed as of September 2021.

Three of the mining companies issued separate statements to inform that they did not feel affected by the modifications to executive order 13851, so their operations would continue the same. The first was Caliber Mining Corp, which on Tuesday the 25th reported from Vancouver, Canada, which would consult with the United States Treasury Department to understand the scope of these sanctions.

Two days later, on Thursday the 27th, the company communicated that after discussing it with his advisers, and reviewing his plans of operations, he confirmed that the sanctions “do not have a material impact on his operations in Nicaragua. complexes [La] freedom and [Mina El] Limón are operating as planned”, maintaining its plan to produce between 220,000 and 235,000 ounces of gold this year.

For its part, Condor Gold said from London that, after reviewing its current and future operations, and consulting with its advisors, the company’s board concluded that “it is unlikely” that executive order 13851, or the sanctions imposed on the General Directorate of Mines, “will have any impact in its current operations in Nicaragua.

Then, on Monday, October 31, Akiba Leishman, CEO of Mako Mining Corp said in a statement that the company was conducting an internal review of the impact of the October 24 measures on current and planned future operations in Nicaragua, in coordination with its US and Canadian advisors,” and that up to that point, its plans did not include “any material changes to its operations In Nicaragua”.

Markets still not recovering

Beyond their optimistic statements, the truth is that none of the four companies that had losses in the stock markets After the extensions to the US sanctioning framework were announced, it has managed to recover the price of its shares on the Toronto and London stock exchanges.

The following data is an update of the stock performance of four of those companies. All the values have been converted to dollars, according to the price of this Friday, November 4, although the indicated percentages refer to the variation in the original currency: Canadian dollars for those that operate in Toronto, and pence for those that trade in London. .

Across the ocean, the markets reacted to the news by punishing the action of the English company Condor Gold, which went from USD 34.5 cents to USD 25.9 cents on the first day, and although 24 hours later a rebound was reported that allowed it to recover a little of land, down to USD 28.9 cents, in the following days the price continued to decline until closing this Friday at USD 23.8 cents, for a total loss of 30.9%.

For its part, the shares of Mako Mining were trading at USD 11.9 cents on October 24, but its price plummeted 28.1% in just one day, to close at USD 8.5 cents. The fluctuations of the following two weeks remained below the starting price all the time, closing this Friday at USD 8.9 cents, which represents a loss of 25%.

Mineros, whose shares had already been losing value on the Canadian stock markets, saw its price fall to USD 62.3 cents on the day of October 24, and plummeted to USD 54.9 cents the next day. The two weeks that followed took the price to USD 63 cents, to close this Friday at USD 49 cents, which represents a drop of 21.4%.

The least hit stock in the accumulated of the two weeks is that of Caliber, whose price fell 26.6% in the first 24 hours (from USD 58.6 cents to USD 43 cents on October 25), showing in the following two weeks a downward trend rise, which led it to close its price at USD 54.9 cents this Friday, November 4, with which its loss was 6.3%.

There are other options if the US decides to sanction

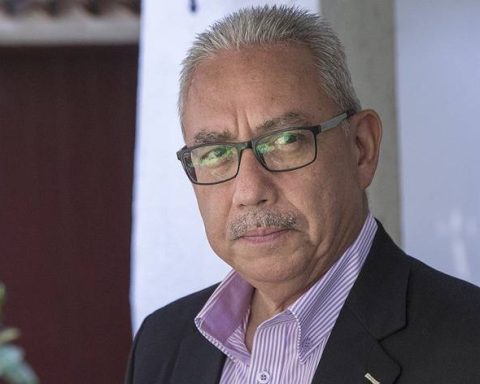

The Mexican-Nicaraguan businessman Mario Hurtado, whom he they expropriated the pawn shop and exporter of precious metals Prisaand an economist who asked to remain anonymous, told CONFIDENTIAL who do not anticipate that switching buyers will be a major problem.

“As there is a great international demand for gold, there would be no major problem in finding new buyers. The biggest problem is the price, because New York and London are the markets that pay the best. On the other hand, sending it to London implies finding new refineries, nothing more, but the logistics to export to new destinations requires some management to make the changes, which does not represent a great difficulty, ”he specified.

For his part, the economist recalled that “gold is a commodity with a high price and appreciation in international markets, and therefore there are alternative markets to which gold can be exported and marketed.”

And while those expert opinions suggest that a US ban would not be an economic catastrophe (nor was the exclusion of the Nicaraguan sugar sector in the quota for fiscal year 2023), there are also no perceived reasons why Nicaraguan gold would no longer have the United States as a destination, since exports are made by mining companies, which are mostly Canadian, Colombian, and English capital.