The President of the Central Bank (BCU), Diego Labat, admitted that the inflation data (7.96%) for 2021 disclosed by the INE it was a number “clearly higher” than the target range of between 3% and 7% and that represents a “great concern” for the monetary authority.

It was the fourth consecutive year without meeting the goal set. Nevertheless, the regional situation regarding the evolution of prices in the last year does not leave Uruguay so badly off, which —excluding Venezuela, which has the world’s highest inflation anyway— was the only country in South America that slowed down the pace of price increases last year.

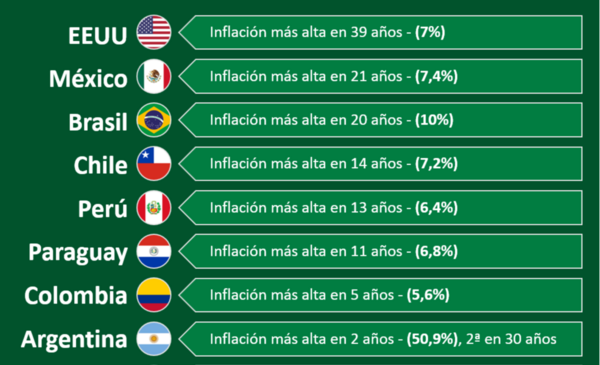

If you look only at the inflation data, Uruguay was in the middle of the table. Among the ten South American countries, three were in a worse situation and five in a better one —which would be six if Ecuador, whose official currency is the dollar, were included. The first group is made up of Venezuela, Argentina and Brazil, while the second is made up of Chile, Peru, Paraguay, Colombia and Bolivia. If the selection is extended to the largest neighbors in the north of the continent, both Mexico and the United States also had better figures than Uruguay.

It is also noteworthy that the Uruguayan economy has had a more marked inflationary behavior for years than that of most neighboring countries, with an average that has been around 8%. This influences the public’s expectations of price increases, which in turn feeds back into the process.

But nevertheless, there is a positive result for the country and it is not the number itself, but its decrease compared to 2020, in an international context of diametrically opposite sign. Annual inflation was 9.41% in 2020, so the figure for the year just ended meant a decrease of almost a point and a half of the indicator.

None of all the countries mentioned was able to slow down inflation as Uruguay did. In fact, the vast majority obtained figures that reached record levels in several years.

In the region (and throughout the world), inflation gained momentum from the extraordinary monetary stimuli that states used to deal with the effects of the pandemic. In addition, the international appreciation of oil, energy, food, and products with volatile prices worked in the same direction.

The Uruguayan inflationary situation compared to that of neighboring countries

The challenge of lowering expectations

Labat explained last week the vision that the monetary authority has on the future scenario. “Our concern is the following: in other countries like Brazil, which today has much higher inflation than us (10%), agents expect inflation for this year of 4%; while for us, on the horizon ( 24 months) that we look at, Uruguayan analysts expect 6.5%”, while businessmen – who ultimately are the ones who set the prices – expect 8%.

In its October report, the IMF argued that central banks should prepare to act quickly if inflation expectations take hold. The agency projects an average inflation of 7.8% for 2022 in Latin America.

In Labat’s opinion, what it has cost in the last time “It is influencing the channel of expectations: the analysts and the financial markets reacted very well from the beginning and now they have remained quiet or have risen a little. Obviously, the expectations of businessmen are the hard core”, he admitted in an interview with Search this week. In any case, the hierarch was confident in bringing inflation this year to the new target range of 3% to 6%, which will be in force from next September. “Our projections clearly give that,” he said.

The Ministry of Economy and Finance (MEF) estimated in the last Rendering of Accounts close this year with an inflation of 5.8% Y the government’s goal is to leave it at 3.7% at the end of 2024.