More and more, millions of people are immersed in different online activities. Actions that were previously only possible in person, today more than by interest, by requirement, are carried out digitally, and the same happens for the management of finances and commercial transactions. However, many times we do not know what methods and products we can use to get the most out of this trend. Knowing this added value allows us to make better decisions, efficiently use the resources we have available, and maximize our possibilities.

Since its creation more than 25 years ago, the Internet has been increasing its penetration with more than 7 billion users worldwide. The New Payments Index 2022 of master card, reveals that the future of the payment industry has arrived and that in Latin America we are active users of digital methods. In the Dominican Republic, 85% of the population with access to this technology has used at least one emerging payment method to meet their daily financial needs. Speed and convenience are just as important factors as security. It is no less true that users prioritize security when deciding which payment method to use, however, they are open to emerging technologies that allow greater speed such as biometric technology.

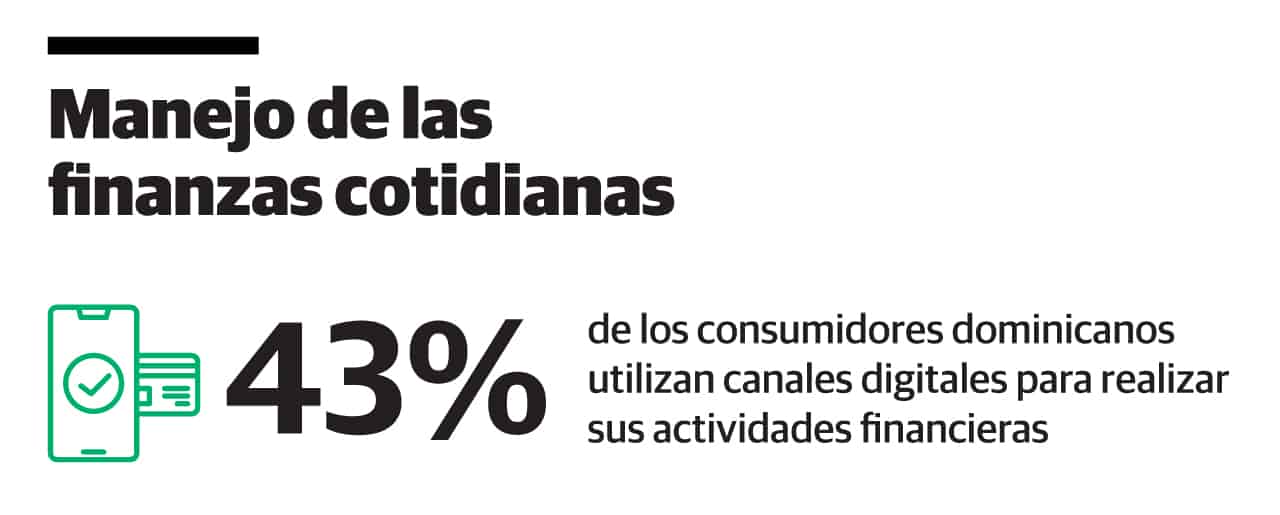

This trend can be seen in the high number of people who are using digital means of payment to carry out banking transactions through the network. And it is here where the financial technology plays a fundamental role.

Security

Certainly, banking transactions require the user to have the security required to take care of their personal and financial data online. This means that having a system that works by and for us improves our quality of life by reducing our worries and giving us more time and peace of mind.

Lifestyle

Although it seems strange, today we can see how not everything is paid for with money. Access to specific places is made possible on many occasions thanks only to special access and invitations. In the world in which we find ourselves, cards become a power and an access route to paths not previously understood or expected by past generations where countless transactions were carried out. These accesses store a value much higher than their initial cost. It is for this reason that currently having a debit or credit card is an ally to live the life we want in the present moment without having to postpone it to a very distant future.

defer payments

When we think of modernity, to be honest, it is sometimes difficult for us to see ourselves as a market with as much access as others. However, it is important to know that in the Dominican market credit card financial products that allow us to buy items without paying in full, but in installments directly with the banking institution. Options such as Buy Now Pay Later (BNPL) is a payment method with short-term financing for both physical and digital purchases and making the payment(s) without interest.

Mobilizations in different currencies

It is extremely useful to be able to carry out, thanks to the use of credit or debit cards, transactions with conventional currencies. Likewise, it is important to know that there are already financial products that allow transactions with digital currencies or cryptocurrencies to be carried out safely, reliably and in real time. When this type of product belongs to world-renowned brands, it allows us to have access from a wide network of places where it is present.

Offers

This type of strategy is widely used by those brands that have managed to understand their type of public and that create and modify their products to adjust them to their needs. For the user, this represents a profit by finding a response to their interests in the market. World-renowned brands, such as master card, allow users who use their credit or debit cards as a payment method, to receive in specific businesses, offering in the Dominican Republic promotions such as reductions in the cost of Claro online recharges, in purchases at Krispy Creme, and when shopping at Papa Johns; counting website caribbean master card, that breaks down the benefits for the Dominican market. Certainly, this generation of alliances has made it possible to broaden the benefits received by consumers, who are now more informed and demanding, preferring those brands that allow them to obtain greater benefits due to their loyalty and preference.

contactless transactions

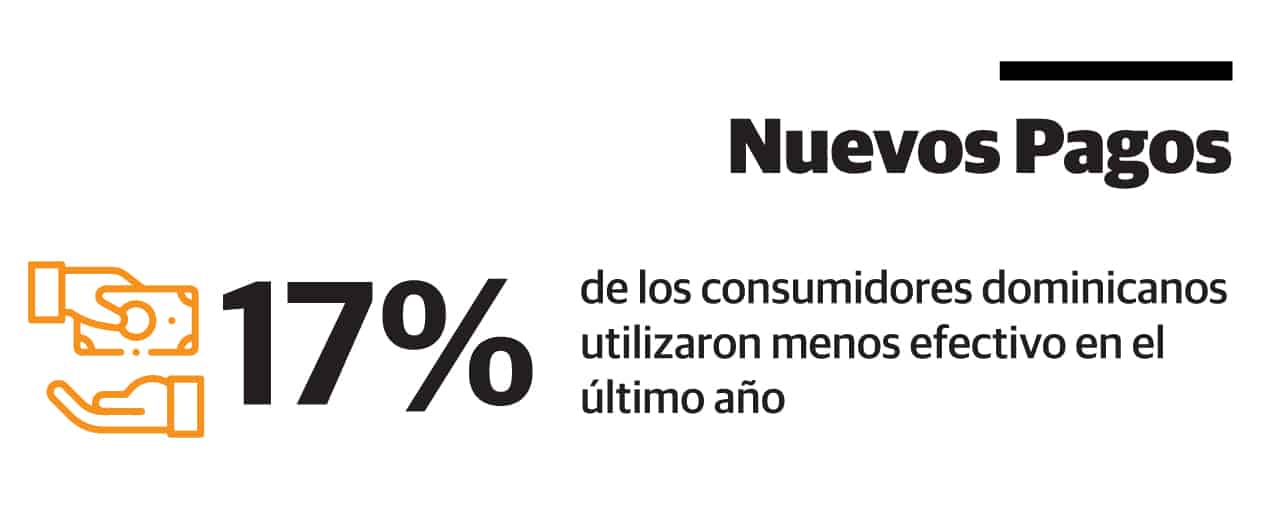

Another benefit that allows us to enjoy making payments through the use of credit or debit cards is contactless payments. This act is becoming increasingly relevant in the current post-pandemic context, where we need to stay connected from a distance to take care of ourselves, avoiding the health problems that cash entails.

Price protection and insurance for purchases

Spending with ease is one of the new advantage of certain credit and debit cards in the Dominican market that offer price protection on these e-commerce sites, receiving refunds for the difference in price of any product purchased if it is found at a lower price elsewhere. And additionally, the protection of purchases with delivery, which allows you to protect purchases from the moment the purchase is made online until the merchandise arrives at the door of our house, covering them in case of damage or non-delivery of the goods. products during the shipping process.

Personalization

Some financial products offer added value to people, companies, and governments because they provide data for critical decision making, which ends up becoming products and services that are more appropriate to the customer and how he behaves.

master card is bringing more merchants into the fold by providing solutions that make card acceptance faster and more secure. This enables Micro, Small and Medium Enterprises (MSMEs) to accept digital payments and offer other digital services that speed up the financial inclusion for the community.

Financial Inclusion

The financial inclusion It helps not only to improve access to available financial goods and services, but also to promote social development, reduce inequalities and enhance access to opportunities. Knowing and taking advantage of these opportunities makes us part of this new way of living, and with it more focused on enjoying what is really important to us.

Approaching a financial institution to find out what your options are and take advantage of the benefits that Dominican banking currently offers you, may be your best option towards a path of greater freedom for you and your loved ones.