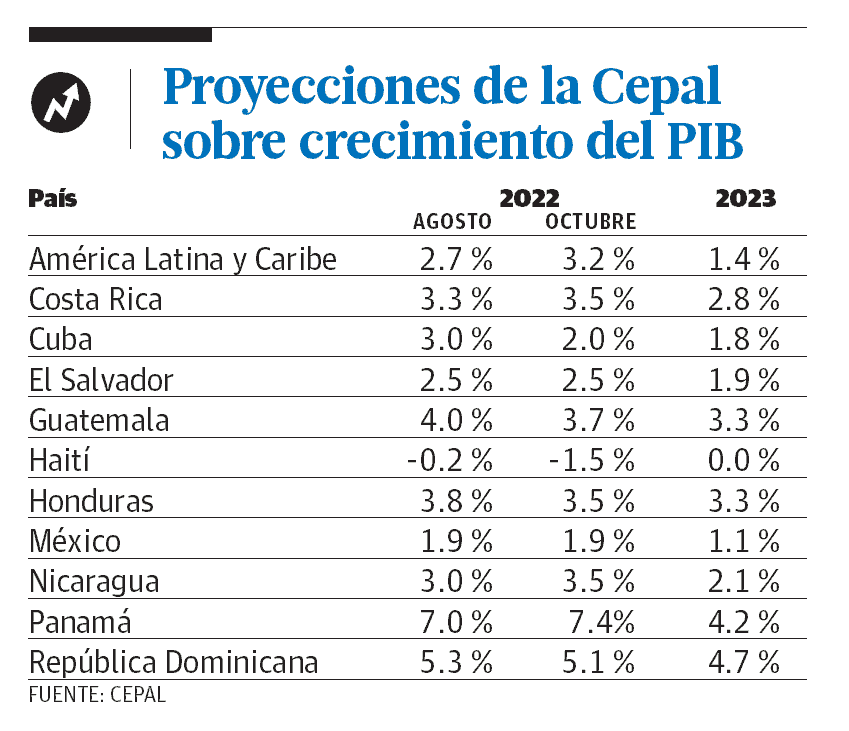

Just as the International Monetary Fund (IMF) did recently, the Economic Commission for Latin America and the Caribbean (ECLAC) decreased yesterday his growth projection of the dominican economy for this 2022: the down from 5.3% which he indicated last August to 5.1%.

Based on gross domestic product (GDP) growth, by 2023, the ECLAC also projects that Dominican Republic will grow less that this year: 4.7%but above Panama (4.2%), Costa Rica (2.8%) and Mexico (1.1%).

Meanwhile, he projects that the Haiti’s growth would be nil (0.0%) in 2023, and changed its projection for this 2022 from -0.2 to -1.5%.

In a press release, the ECLAC reported that by 2022 a 3.2% growth for Latin America and the Caribbeanhigher than that indicated last August.

But for next year he expects the slowdown is accentuated in the regionwith a growth of 1.4% in 2023, “in a situation subject to important restrictions, both external and domestic”.

In a report published last week, the IMF also decreased to 5.3% the projection of growth of the Dominican economy for this 2022, from the 5.5% that it had disclosed in April of this year. Also, down to 4.5% the one scheduled for the 2023when I had projected it at 5.0%.

All would show lower growth in 2023, according to the new ECLAC projections.

-

South America will grow 1.2% in 2023 (3.4% in 2022).

-

The group made up of Central America and Mexico will do so at 1.7% (compared to 2.5% in 2022).

-

The Caribbean will grow 3.1%, not including Guyana (compared to 4.3% in 2022).

Influencing factors

The ECLAC indicated that the war conflict between Russia and Ukraine negatively affected global growth -and with it the external demand that the region faced this year- together with accentuating the inflationary pressuresvolatility and financial costs.

“The biggest risk aversionNext to the tighter monetary policy by the main central banks of the world, hurt capital flows towards emerging markets, including Latin America, in addition to propitiating depreciation of local currencies and making it more onerous to obtain financing for countries”, observed the organism.

The entity, dependent on the United Nations, projects that in 2023“the countries in the region will be faced again with a unfavorable international contextin which a slowdown in both growth and global trade, higher interest rates and less global liquidity are expected.

He stressed that, internally, the countries region of will face again in 2023 a complex environment for fiscal and monetary policy.

Monetary policy for 2023

He recalled that, in monetary terms, the rising inflation led central banks, as in most of the world, to raise policy rates -in some cases substantially- and reduce the growth of monetary aggregates.

“Although it is expected that in 2023 this process arrives At its end – to the extent that inflation expectations are anchored in the countries – the effects of this restrictive policy on private consumption and investment will be present during 2023,” he estimated.