The natural gas prices have increased since the Russian invasion of Ukraine began. After months of fights and threats, Russia decided to cut the service due to alleged leaks in the Nord Stream Two gas pipeline, which, until now, remains closed.

This situation has increased the value of fossil fuel, as winter is approaching and there are still no effective solutions to help the European continent and only an energy reduction plan is foreseen, which is insufficient for demand. But how does this impact shortage to Latin America?

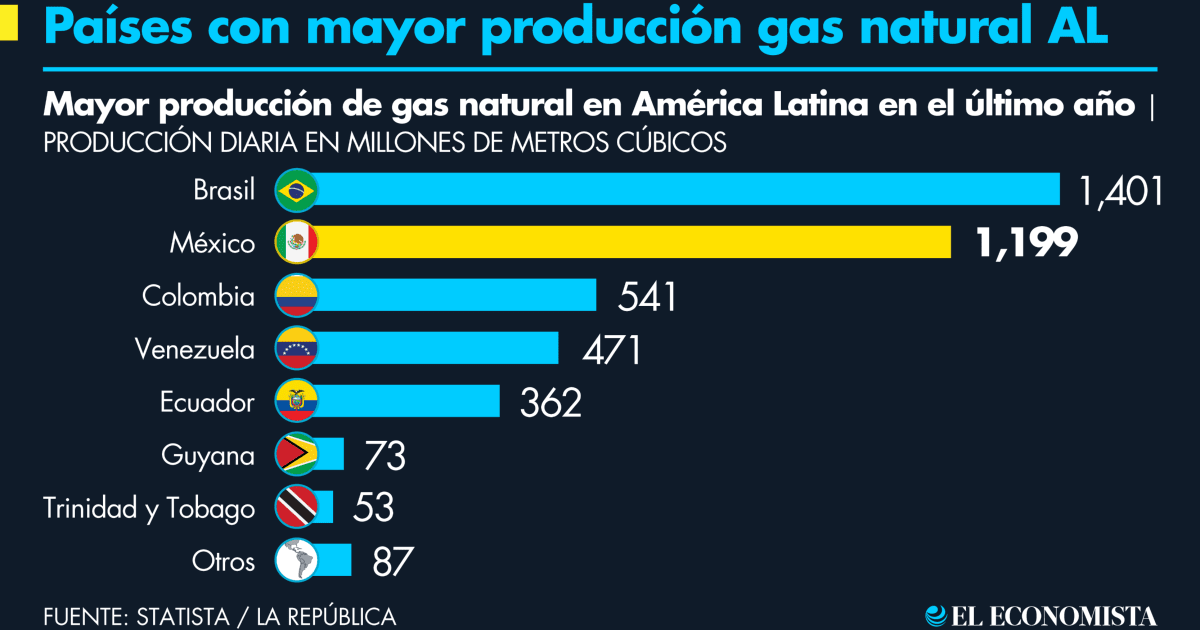

In the region, the largest producers of this product per day during the last year were: Brazilwith 1,401 million cubic meters; Mexico, with 1,199 million cubic meters; Colombia, with 541 million cubic meters; Venezuela, with 471 million cubic meters; Ecuador, with 362 million cubic meters; Guyana, with 73 million cubic meters; and Trinidad and Tobago, with 53 million cubic meters.

The panorama can have positive and negative effects in the region thanks to the fact that the hydrocarbon could be exported from countries such as Brazil and Mexico; however, being the main raw material for fertilizers, it would trigger an increase in food prices.

Latin America stands out for being a commodity exporting region and little exposed to Europe, so it has benefited from the rise in the prices of raw materials such as oil; however, the risk remains that demand will be reduced in the face of the possibility of a global recession.

“The safest thing is that a large part of the gas that is produced globally is going to be taken to Europe, which is why it will begin to become a fundamental commodity for the reactivation and to maintain the Latin American economies,” said Víctor Mijares, Professor of Political Science and Global Studies at the Universidad de los Andes.

The value of this type of input is projected to continue to increase, affecting the availability of energy and gasoline in much of Europe and in turn creating an unfavorable environment for food, especially in the region.

the war between Russia and Ukraine has impacted most countries, but especially the nations of Europe, who are closely dependent on 40% of supply from Russia, which is equivalent to 72% of hydrocarbon exports.

This country is the second largest gas producer in the world with a production of 701,000 million cubic meters per year. The first is the United States with 934.2 billion cubic meters per year, while the third is Iran, with 256.7 billion cubic meters.

As for oil, yesterday it managed to recover after considerable falls. The WTI rose 1.75%, trading above US$78 a barrel, while the Brent increased 2.08% to US$86 on average.

The rebound in crude oil is due to the great rise in the dollar, which despite cutting the gains of past days, remains at high levels, compared to other economies. In addition, the possible cut in supply due to the passage of Hurricane Ian also influenced crude oil prices.

“Oil is currently under the influence of financial forces,” said Tamás Varga, an analyst at the PVM oil broker. “Meanwhile, relief spikes, like the one this morning caused by Hurricane Ian in the US Gulf, are considered temporary events,” he added.