For the Administrators of pension funds (AFP) dismantle the idea that there are casualties in the country pensionsattributed to private management, experts raised some challenges that can become an opportunity for improvement to inform the population and achieve goals to adapt the system to new needs.

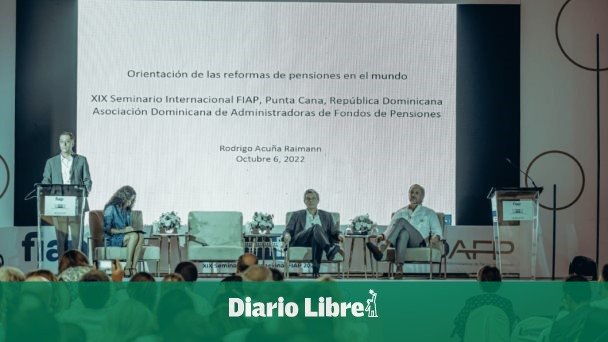

After the consequences brought by the pandemic of the COVID-19a “wrong” perspective on the development and management of the Pension fundsa situation that has given way to disinformation, considered the president of FIAP, William Arthur, During his participation in the XIX Seminar International of the International Association of Administrators of Pension funds (FIAP).

Among the challenges highlighted by international and national experts who analyzed the strengths and weaknesses with which companies in the pensions to improve the system are:

– In times of high international and local financial volatility, optimize portfolio management and seek regulatory changes to expand assets.

– Provide information and advice to contributors and employers, avoiding technical terms that make it difficult to understand.

– Possess information in various presentation formats on account management, financial results and options to help members and pensioners make decisions.

– Design a financial education program that encourages savings and good budget management.

– Invest more resources in technical research studies to improve the system, through the comparison of the Individual Capitalization Accounts (CCI) and the pay-as-you-go system.

– Work closely with international organizations, the media, stock exchanges and trade associations. Pension funds from developed countries and voluntary funds.

– Open continuous and effective communication channels with pensioners and affiliates to contribute to the generation of citizen awareness about the importance of funds for the economy.

The seminar entitled “Challenges and solutions for pensions of today and tomorrow” was held in Bávaro, Punta Cana, on October 6 and 7, 2022 with the participation of rrepresentatives of pension fund managers from more than 15 countrieswho exchanged experiences and market trends.