The Colombian economy is approaching its final stretch, and for the last quarter of the year there are several challenges that it will have to overcome to make a soft landing by 2023. rest of the year a marked slowdown is expected: high inflation also accompanied by high interest rates, the tax process, the discussion of the minimum wage and a challenging global environment.

(Read: Banrep vs. inflation: what is the Issuer doing to lower prices).

In terms of growth, although the GDP figure for the third or quarter is still pending, andhe market expects a much more timid economic activity. And although the latest figures that are recorded are those of July, sectoral indicators such as industry and commerce already show growth with lower rates.

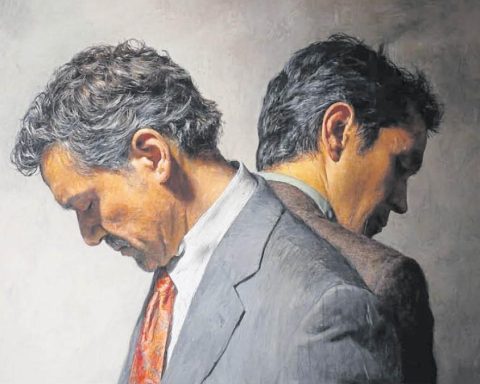

“Until the second quarter the trends were very positive, but there are already different signs of a slowdown in the economy, and in addition, the international context is very adverse both in terms of inflation and productive activity”, said the Minister of Finance, José Antonio Ocampo.

In terms of inflation, the country also faces a complex scenario, since in August it closed at 10.84%, and expected to reach 11% by September, which is also accompanied by an increase in the interest rate of the Banco de la República, which is already at 10%. Added to this, the usury rate has continued to rise, for October it is at 36.92%, and this can impact credits and consumption.

(Also: Rates rose: should we stop using cards and not ask for credits?).

In addition, the quarter started with a high dollar, after a hectic day on Friday, the currency closed at $4,590.54; and with an oil trading at US$87.96 in the Brent reference. And October also marks the beginning of the increase in gasoline prices announced by the Government to cover the deficit of the Fuel Price Stabilization Fund (Fepc).

For experts, the last part of the year will be accompanied by several challenges, as pointed out by Juan Pablo Espinosa, director of Economic, Sectoral and Market Research at Bancolombia. “The way in which prices can continue to fluctuate around 11% and 12% would imply a very worrying year-end, taking into account indexation, which can continue to affect the CPI for 2023“, said.

The economist also referred to the situation in relation to the global environment, with clearer signs of a slowdown in the largest economies. “This has an impact on different financial and real channels, and the performance of the capital markets has been very negative in recent weeks,” and also stressed that this will be a challenge due to the financing needs due to the fiscal and account deficit. stream.

Juan David Ballen, Director of Analysis and Strategy at Casa de Bolsa, also referred to the fact that there is a lot of uncertainty around the tax, and said that “Until the last draft and approval is received, that to a certain extent could be influencing the fact that the investment could be affected in this last quarter”.

(Read: A deep recession is not necessary to curb inflation: expert).

Due to inflation and high rates, he said that he also there would be an impact on household consumption and demand, and also because of the dollar, which not only directly impacts consumption, but also investment. Another issue, although he assured that it does not affect the end of the year so much, but more towards 2023, but that it can generate uncertainty, is the discussion of the minimum wage.

In turn, Munir Jalil, chief economist at BTG Pactual for the Andean region, assured that the landing should begin from the third quarter, and that “the fourth quarter is like a continuation of lower growth.”

Jalil also said that he expects credit growth to begin to fall, marked by the BanRep rate, and that the fourth quarter will be marked by a continuation of the Issuer’s upward cycle.

LAURA LUCIA BECERRA ELEJALDE