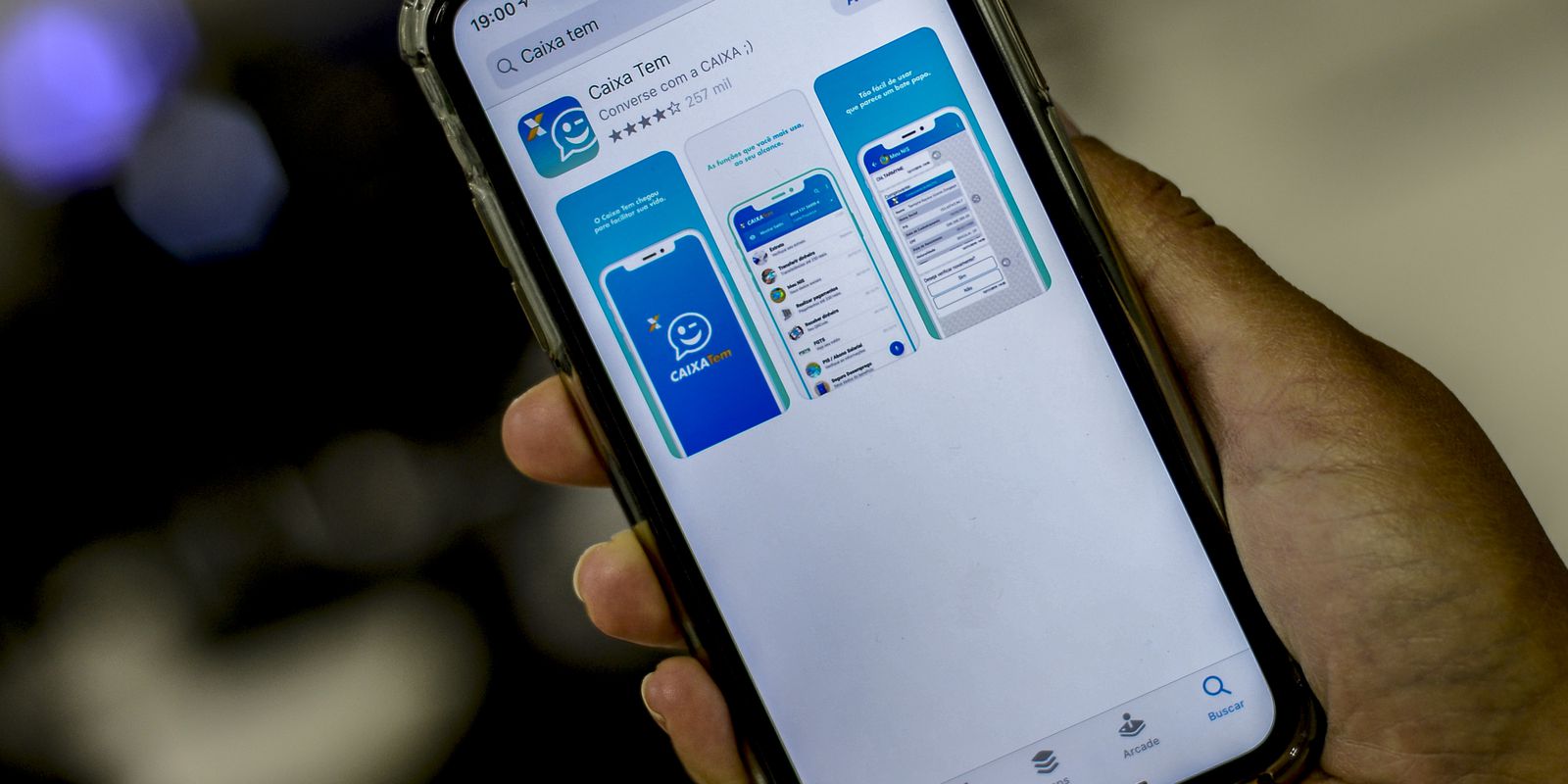

Caixa Econômica Federal announced the reduction of the minimum amount for anticipation of withdrawals-anniversary of the Severance Indemnity Fund (FGTS). This amount went from R$ 2 thousand to R$ 500. In addition, the bank made available since yesterday (28) the advance of this type of withdrawal. Workers can anticipate up to three years of their birthday withdrawal completely digitally, directly through the Caixa Tem application.

The loan is made available to customers who signed up to the FGTS birthday withdrawal, from active or inactive FGTS accounts. It is also necessary to indicate Caixa as the financial institution authorized to offer the anti-payment-birthday line, a procedure that can also be carried out by Caixa Tem.

The prepaid amounts are available to the customer on the business day following the contract. On the date of payment of the withdrawal-birthday, the debit is automatically made to the worker’s FGTS account, settling the operation. According to Caixa, there is no impact on the person’s ability to pay or the possibility of contracting other lines of credit at the bank.

You must have Caixa Tem installed on your cell phone and your registration updated to request advance payment. The bank does not require credit risk assessment, allowing contracting even for customers with registration restrictions. The interest rate is 1.49% per month.

birthday withdrawal

Withdrawal-anniversary allows the withdrawal of part of the balance of any active or inactive FGTS account each year, in the anniversary month, in exchange for not receiving part of what is entitled in the event of unfair dismissal.

The money can be withdrawn up to two months after the birthday month. The amount to be released varies according to the balance of each account in the employee’s name. In addition to a percentage, he will receive a fixed additional, according to the total in the account. The amount to be withdrawn varies from 50% of the balance without additional installment, for accounts up to R$500, to 5% of the balance and an additional R$2.9 thousand for accounts over R$20 thousand.

By withdrawing a portion of the FGTS each year, the worker will no longer receive the amount deposited by the company if he is dismissed without just cause. Payment of the 40% fine in these situations is maintained. Other FGTS withdrawal possibilities – such as property purchase, retirement and serious illnesses – are not affected by the birthday withdrawal.