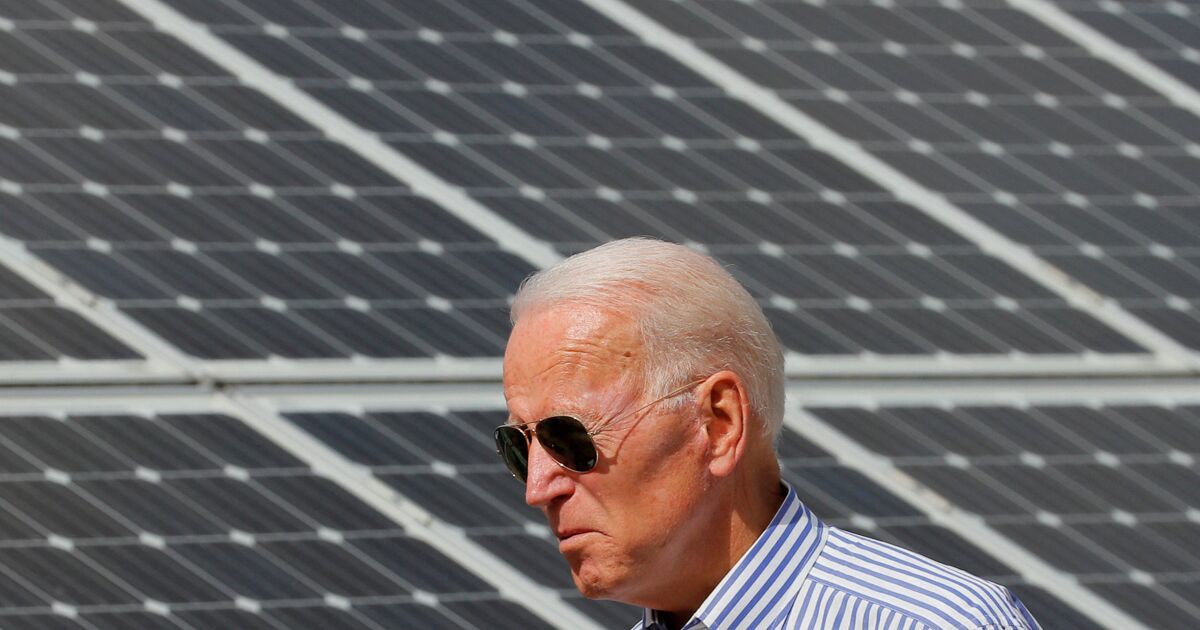

The bill will now go to the Democratic-controlled House of Representatives, which is expected to pass it on Friday. President Joe Biden will then sign it into law.

The tax changes will take effect from next year.

The two taxes are estimated to reduce earnings per share of S&P 500 companies by about 1.5% in 2023, according to a research note from Goldman Sachs, which said it expects larger declines in sectors with a low effective tax rate, such as health and computing

UBS Americas Chief Investment Officer Solita Marcelli similarly estimated that the proposed new taxes would have “a minimal drag, 1%, on S&P 500 earnings per share, although some companies will be hit harder than others.” “.

Still, some investors predicted a rush of share buybacks.

“What stands out the most is that you’re going to see an acceleration in buybacks before the end of this year,” said Thomas Hayes, chairman and managing member of Great Hill Capital. “Companies prefer not to pay this tax … They have this window, and you can be sure that they will take advantage of it.”

Buybacks hit a record $281 billion in the first quarter of 2022, according to S&P analyst Howard Silverblatt, though they fell 17.4% in the second quarter. However, he doesn’t see the 1% tax inhibiting corporate buybacks in general.

Jaret Seiberg of Cowen Washington Research Group also said it will be difficult “to see companies change their behavior” in response to the 1% tax. However, there is a risk that taxing dividends will become an “easy way to raise more money” and Congress will raise the 1% in the future, he added.

Some sectors, meanwhile, got a boost on Monday, with shares in US automakers including Tesla Inc TSLA.O, Rivian Automotive Inc RIVN.O, Ford Motor Co FN, General Motors Co GM.N and Lordstown Motors. Corp RIDE.O up 1%-2%.

The bill creates a $4,000 tax credit for used electric vehicles (EVs) and provides billions in financing for electric vehicle production.

“Some of the EV grants and incentives will come in handy and help Ford and GM and the Teslas of the world get more orders,” Hayes said.

Biotech and pharmaceutical stocks should rebound after some uncertainty because the bill is “less onerous than initially anticipated in terms of negotiating drug prices,” Hayes said.

“Overall, it’s a net positive,” Hayes said.

Shares in biofuel producers rose on Monday, including Darling Ingredients DAR.N, Neste NESTE.HE, Gevo Inc GEVO.O and Renewable Energy Group REGI.O, as they are expected to get a boost from the broadening. of the tax credit for biofuel blenders and the addition of tax credits for sustainable aviation fuels included in the Act.