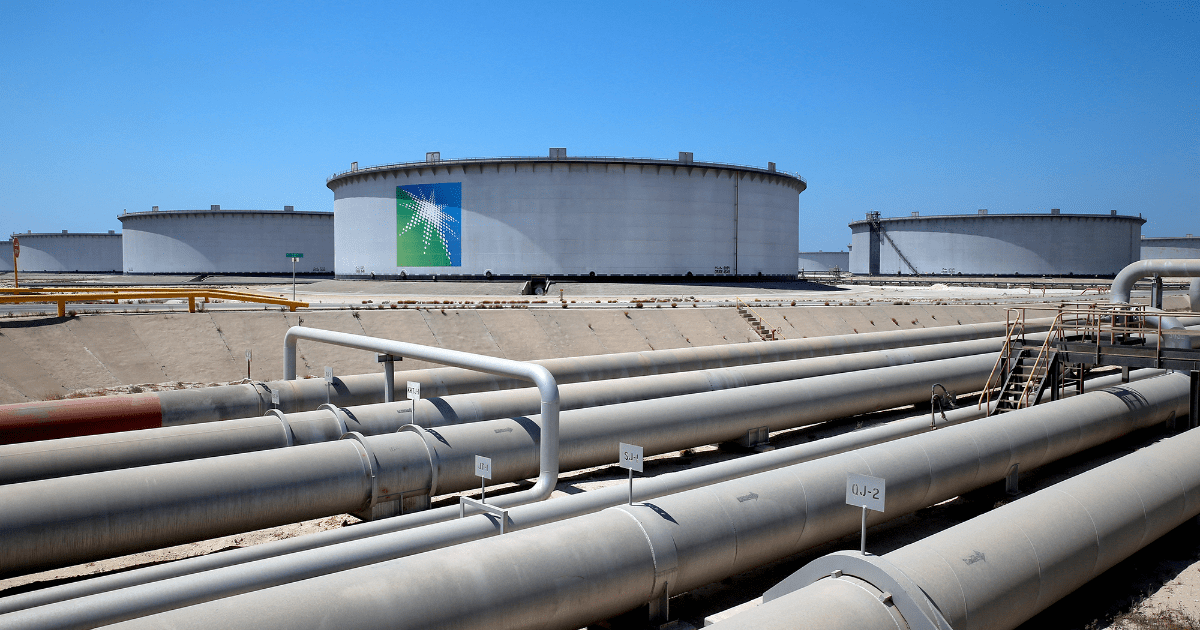

Saudi Arabia will be the country with the highest growth in 2022, forecasts the International Monetary Fund (IMF). Saudi Arabian GDP will increase 7.6%, thanks to high oil prices. They produce 12.4 million barrels a day and have the lowest cost of production among the world’s largest producers, less than $6 a barrel.

The country governed by Prince Mohamed bin Salmán is one of the few that will be able to speak of 2022 as an excellent year, from an economic point of view. So good are the Saudi numbers that they have the luxury of announcing the construction of a new city, NEOM, which will cost 500,000 million dollars and aims to have zero carbon emissions with five million inhabitants. This city will be a production and logistics center; It constitutes the most important step for Saudi Arabia to diversify its economy, until now dependent on oil for 46% of its Gross Domestic Product.

Let’s remove that oil country from the map and we are left with a world that faces a panorama of darkness and uncertainty. Gloomy and More Uncertain, is the title of the IMF’s report released yesterday. The covid pandemic continues to wreak havoc; The war in Ukraine has established itself as the great disruptor of the energy and food markets, in addition to exacerbating geopolitical fragmentation.

In the new global scenario, there is little hope of achieving international collaboration to solve major problems. This slows down global trade and fuels inflation around the world, among other things. In this dark and uncertain new world, central banks are forced to go far beyond what they planned in terms of tightening monetary policy: rate hikes will be more severe and will be complemented by the withdrawal of enormous amounts of money.

The outlook facing the world is one of the worst in the last 50 years, warns the IMF’s chief economist, Pierre Olivier Gourinchas. The time reference is not arbitrary: in the first half of the 1970s, the world experienced a crisis that began with an oil shock, related to the birth of the Organization of Petroleum Exporting Countries (OPEC). It is said that the world is now less dependent on oil, because each unit of GDP requires less black gold to produce. It is true but it is clear that oil is not the only variable to consider: we have the pandemic and the climatic disorder… the interconnectedness of the world.

That prodigy of information technology that allows news and fake news to be known in seconds and billions of dollars to move with two or three clicks. That interconnectedness means the world has picked up speed and is moving much faster than it was in 1973. We have a lot more pepper to spice up the tough times and make them more dangerous.

In the final part of its 19-page report, the International Monetary Fund puts on the table two possible scenarios to consider. One has to do with the interruption of Russian gas supplies to Europe and the other with the financial impact of rising interest rates in developing countries. They are quite likely scenarios.

The first would bring a severe recession to Europe, accompanied by more inflationary pressures. Increases in interest rates will accentuate the vulnerabilities of many undeveloped countries. This means many things: devaluation pressures on their currencies, difficulties balancing public accounts and, eventually, risks of political or social instability.

A ray of light over Mexico

The IMF report grants an improvement in the forecast of the Gross Domestic Product for Mexico in 2022. Instead of 2.0% that the international organization projected in April, it now estimates that it could reach 2.4%, thanks to the “good” behavior of the economy Mexican in the first semester. I put the quotes to put the magnifying glass on the numbers. Between January and March, the GDP grew 1.8 percent. Between April and June, everything indicates that it did not grow more than 1.0 percent. Everyone agrees that the second semester will be more complicated. Therefore, it is difficult to find where the 2 percent will come from. Time will tell. Among the optimistic forecasts, we have that of the Treasury and that of BBVA, which also revised Mexico’s GDP upwards a couple of weeks ago. How will that ray of light behave amid so much darkness and uncertainty?

General Editorial Director of El Economista

Safe

Degree in Economics from the University of Guadalajara. He studied the Master of Journalism in El País, at the Autonomous University of Madrid in 1994, and a specialization in economic journalism at Columbia University in New York. He has been a reporter, business editor and editorial director of the Guadalajara newspaper PÚBLICO, and has worked for the newspapers Siglo 21 and Milenio.

He has specialized in economic journalism and investigative journalism, and has carried out professional stays at Cinco Días in Madrid and San Antonio Express News, in San Antonio, Texas.