The distribution of R$ 13.2 billion of the profit of the Severance Indemnity Fund (FGTS) in 2021, approved today (22) by the Board of Trustees of the fund, will be divided proportionally among the quota holders. The greater the balance of the account linked to the FGTS, the more the worker will have to receive.

The reference value corresponds to the balance of each account on December 31, 2021. Anyone who has more than one account will receive credit in all of them, respecting the proportionality of the balance.

To know the share of the profit that will be deposited, the worker must multiply the balance of each account in his name on December 31 of last year by 0.02748761. This factor means that, in practice, for every R$ 1 thousand of balance, the shareholder will receive R$ 27.49. Those who had R$ 2 thousand will have a credit of R$ 54.98, with the amount rising to R$ 137.44 for those who had R$ 5 thousand at the end of 2021.

The percentage of the profit that would be passed on to workers was defined today by the Board of Trustees and is equivalent to 99% of the profit of R$ 13.3 billion obtained by the FGTS in 2021. The distribution of the profit will increase the FGTS income this year to 5.83 %, lower than the official inflation of 10.06% by the Broad National Consumer Price Index (IPCA) last year. This is the first time since 2017 that FGTS earnings will not be able to replace losses from inflation.

Even losing inflation, the FGTS yielded more than the savings account. Last year, savings yielded only 2.94%, influenced by the Selic rate (basic interest in the economy), which remained at 2% per year for most of 2021 and was only increased from August last year.

By law, the FGTS earns 3% per year plus the reference rate (TR). With the TR at 0.209%, the minimum yield corresponds to just over 3% each year. With the distribution of profits, the remuneration of the Guarantee Fund is increased.

How to check the balance

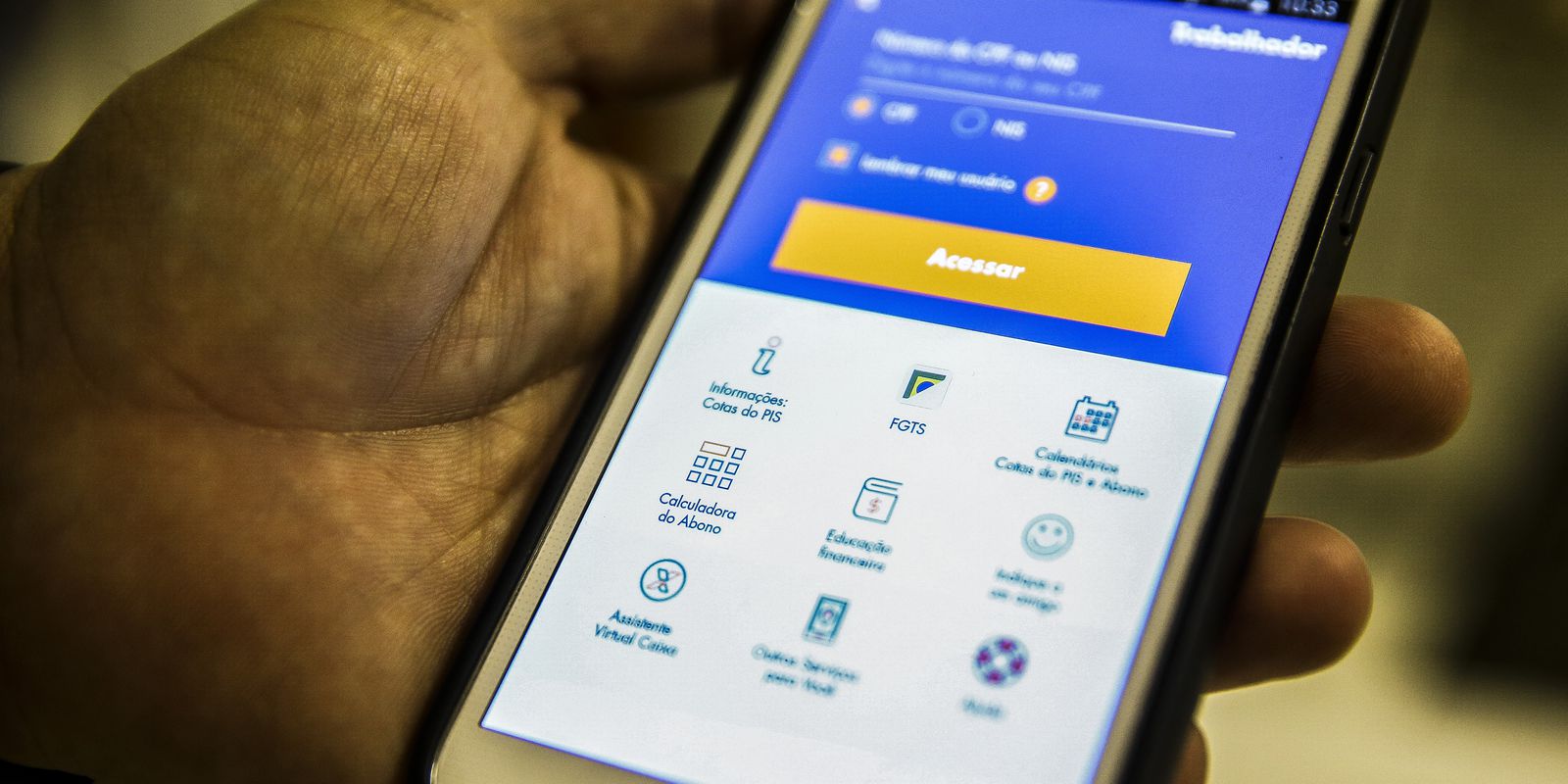

To check the balance of the Guarantee Fund, the worker must consult the extract of the fund, in the FGTS application, from Caixa Econômica Federal. Until recently, the bank offered the option of consultation by site of the institution, but all electronic service related to the FGTS was migrated exclusively to the application, available for smartphones and tablets of systems android and iOS.

Those who cannot make the consultation over the internet should go to any Caixa branch to ask for the statement at the service desk. The bank also sends the FGTS statement on paper every two months, at the registered address. Those who have changed residence should look for a Caixa branch or call 0800-726-0101 and inform the new address.