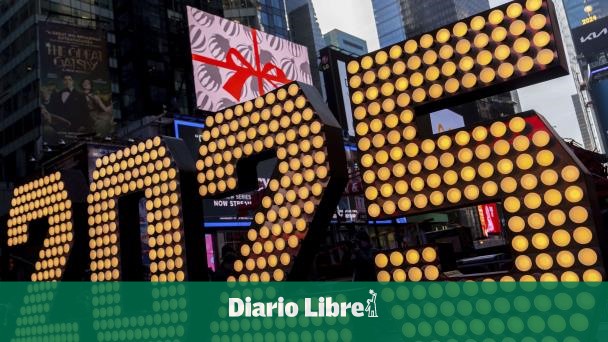

With the end of 2024 just around the corner, you may be reflecting on your goals financial by 2025.

Whether you are saving for move of your parents’ house or liquidate your credit student, the resolutions financial They can help you stay motivated, said Courtney Alev, consumer advocate at Credit Karma.

“The start of a new year does not erase all of our financial challenges from the previous year,” Alev noted. “But it can really help you adopt a fresh-start mentality in the way you manage your finances.”

If you plan to do resolutions financial For the new year, experts recommend that you start with assess the state of your finances in 2024. Then, establish goals and make sure they are achievable based on your lifestyle.

Here are some expert tips:

Change your relationship with money

Think about how you currently deal with finances: what is good, what is bad, and what can be improved.

“Let this be the year you change your relationship with the money“said Ashley Lapato, personal finance educator for YNAB, a budgeting app.

If you feel that the money It is a task, that the theme of money It’s something shameful, or like you were born “bad with it.” money“It’s time to change that mentality, Lapato said.

To adjust your focus, Lapato recommends looking at the goals monetary as an opportunity to imagine the lifestyle you want in the future. He recommends asking questions like, “How do I see myself in my 30s? How do I see myself in my 40s?” and use the money as a means to get there.

Liz Young Thomas, head of Investment Strategy at SoFi, added that it is key that you sorry for the errors past to start the new year with motivation.

Know your “why”

When you establish your resolutions financial By 2025, it’s important to determine the “why” of each, said Matt Watson, CEO of Origin, a tracking app. financial.

“If you can link the financial goal to the larger life goal, you will be much more motivated and more likely to continue on that path,” Watson said.

Whether you’re saving to buy a house, pay off your credit card debt credit or taking a summer vacation, having a clear goal can keep you motivated. Watson also recommends using a tool to help you track your finances, such as an app, spreadsheet, or website.

Budget, budget, budget

“After three years of inflation, your pay increases are probably still trying to catch up with your monthly expenses, making you wonder where all the money is going.” money“said Greg McBride, analyst financial head of Bankrate. “Do that budget monthly by 2025 and aim to adjust your spending to it throughout the year.

McBride said you may need to make adjustments throughout the year as certain expenses increase, which would require cutting back in other areas.

“Adjust your expenses to your income, and any month you spend less than budgeted, transfer the difference to your account. savingsideally, to an account savings high performance,” he said.

Pay your debts earrings

“It is not likely that the rates of interest go down very quickly, so you will still have to work hard to pay the bills. debtsespecially those of cards credit high cost, and do it urgently,” McBride said.

Start by taking stock of the current amount of your debts in relationship with the beginning of the year. It is desirable that you have made steady progress in paying them off, but if you have gone in the opposite direction, McBride recommends making a game plan. That includes looking for 0% balance transfer offers.

Take control of the rate of interest of your card credit

“You have more power over rates interest of the cards credit than you think,” said Matt Schulz, chief analyst at credit by LendingTree. “Exercising that power is one of the best moves you can make in 2025.”

A card credit with 0% balance transfer is “a good weapon” in the fight against the cards’ high APRs, he said. A personal loan with a rate low interest It is also a good option.

You may simply have to pick up the phone and ask for a rate of interest lower. LendingTree found that most people who did so in 2024 were successful, and the average reduction was more than 6 points.

Sets goals realistic and practices

When you plan your resolutions financialit is important that you take into account how you are going to make your goals are sustainable for your lifestyle, said Alev of Credit Karma.

“It really is a marathonnot one career short,” Alev said.

Alev recommends establish goals realistic and practices to facilitate compliance. For example, instead of planning save thousands of dollars by the end of the year, start saving $20 for every paycheck you receive.

Even if your plans are achievable, there will be times when you go off the rails. Maybe it’s an unexpected medical expense or an extraordinary life event. When these situations occur, Alev recommends trying not to feel defeated and working to get back on track without feeling guilt.

Don’t bury your head in the sand

“You can’t manage what you can’t see, so set a New Year’s resolution to check your score of credit monthly in 2025,” said Rikard Bandebo, chief economist at VantageScore. “Make sure you pay more than the minimum on your insurance accounts. creditsince that is one of the best ways to improve your score of credit“.

Bandebo also advises those with student loans to make all payments on time, as servicers will begin reporting late payments starting in January, and these will affect the score of credit of the borrowers.

Automate the savings whenever possible

Automated changes, such as increasing retirement plan contributions, setting up direct deposits of paychecks into saving intended for that purpose and organize monthly transfers to a bank account. saving for retirement and/or accounts saving college, they add up quickly, McBride said.

Slow down

Your goals financial can encompass more than just better managing your money; They can also consist of maintaining your money safe from the scams. A golden rule to protect you from scams is “decelerate“said Johan Gerber, executive vice president of security solutions at Mastercard.

“You have to decelerate and talk to other people if you’re not sure (if) it’s a scam,” said Gerber, who recommends building an accountability system with family to keep you and your loved ones safe.

Scammers use urgency to make people fall for their tricks, so taking your time making any financial decision can prevent you from losing. money.

Focus on your welfare financial

Your goals financial They do not always have to be rooted in a number of money; They can also be about you welfare. Finances are deeply linked to our mental health, and to take care of our moneywe also need to take care of ourselves.

“I think, now more than any other year, you welfare financial should be a resolution,” said Alejandra Rojas, personal finance expert and founder of The Money Mindset Hub, a mentoring platform for female entrepreneurs. “Your mental health with money should be a resolution.”

To focus on your welfare financialcan establish one or two goals focused on you relationship with the money. For example, you could find ways to address and resolve trauma financialeither establish a goal to talk more openly with your loved ones about the moneyRojas said.